What to Do About the 35% of Checking Customers Costing You Money

This content originally appeared here: [ LINK ]

By Mike Branton

Consumer checking, while the simple hub product for most retail deposit and loan relationships, produces some not so simple challenges related to financial performance.

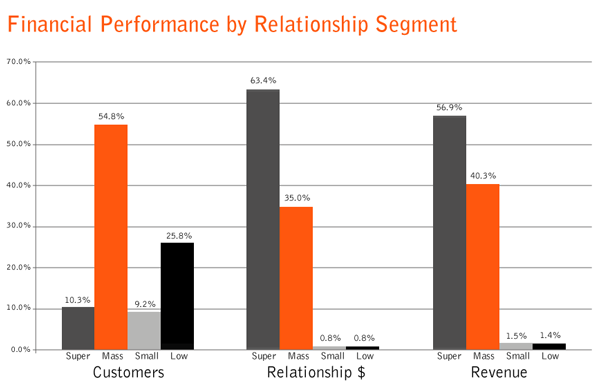

Here’s the composition of a typical financial institution’s checking portfolio, based on the revenue generated by a household relationship. “Super” customers generate the highest percentage of a typical bank’s revenues although they make up only about 10 percent of its customers. Super customers also make up the highest percentage of overall relationship dollars, meaning they have more combined deposit and loan balances with the bank.

Super: household produces annual revenue over $5,000. Mass Market: produces $350 to $5,000 in revenue. Small: produces $250 to $350 in revenue. Low: produces less than $250 in revenue. Figures are based on the average bank in StrategyCorps’ proprietary database of more than 4 million accounts.

The challenge: What to do with the Small and Low relationships that make up 35 percent of customers yet represent only 1.6 percent of all relationship dollars and 2.9 percent of revenue?

A deeper dive into the profile of these segments is enlightening.

| Segments | Small $250-$350 | Low <$250 |

| Distribution | 9% | 26% |

| Per Account | Averages | Averages |

| Relationship Statistics | ||

| DDA Balances | $1,561 | $682 |

| Relationship Deposits | $444 | $117 |

| Relationship Loans | $161 | $32 |

| Total Relationships | $2,166 | $831 |

| Revenue Statistics | ||

| Total DDA Income (NII + Fees + NSF) | $160 | $62 |

| Relationship Deposit NII | $16 | $4 |

| Relationship Loan NII | $6 | $1 |

| Total Revenue | $182 | $67 |

| Account Statistics | ||

| Have More Than One DDA | 28.9% | 14.5% |

| Have a Debit Card | 71.4% | 57.1% |

| Have Online Banking | 27.3% | 22.0% |

| Have eStatement | 17.1% | 13.9% |

| Debit Card Trans (month) | 13.3 | 5.0 |

| Have a Relationship Deposit | 31.5% | 17.9% |

| Have a Relationship Loan | 7.1% | 2.7% |

| Have Both a Deposit and Loan | 2.5% | 0.7% |

| Average Age of Account | 3.1 | 3.4 |

| Average Age of Account Holder | 48.9 | 48.8 |

Obvious is the lack of revenue generation from these segments given average demand deposit account (DDA) balances and relationship deposit and loan balances on an absolute dollar basis and a comparative basis to the Mass and Super segments.

Less obvious is that the other revenue-generating (debit cards) or cost-saving activities (online banking, e-statements) of the average customer in the Small and Low segments is not materially different from the Mass and Super relationship segments. For some products, like a debit card, the percentage of customers in the Small and Low segments who have one is higher than Mass and Super segments.

The natural response from bankers when confronted with this information is, “let’s cross-sell these Small and Low relationships into more financial productivity.” This is well-intentioned, but elusive and arguably impractical.

First, for many consumers in these relationship segments, your FI isn’t their primary FI, so they are most likely Mass or Super segment customers at another institution. Second, if you are the primary FI, these segments simply don’t have financial resources or the need for additional financial products beyond what they already have today. At their best, these are effectively single service, low balance and low or no fee customers. Therefore, traditional cross-selling efforts either compete unsuccessfully with the primary FI’s cross-selling efforts or don’t matter because there aren’t available financial resources to be placed in other products.

How then does your FI competitively and financially engage with these Small and Low relationship segments to improve their financial contribution by increasing the DDA balances, relationship balances or generating more fee income? The answer is to relevantly offer them a product that impacts how they bank with your institution.

More specifically in today’s marketplace, this relevant offering is accomplished by being a bigger part of your customers’ mobile and online lifestyle. Consumers of all types are in a relationship with their smart phone, tablets and computers. A FI’s checking product has to be a bigger part of that relationship. It can’t just be another online or mobile banking product they can get at pretty much any FI. For the unprofitable customers who have a primary FI somewhere else, the mobile and online offerings have to be engaging and rewarding enough to move deposit balances to your bank or buy more products from your bank to generate more revenue.

For those unprofitable customers who simply don’t have the financial resources to aggregate deposits or be cross-sold, the mobile and online banking solutions have to include value worthy enough to willingly pay for. Why? Because generating recurring, customer-friendly fee income based on non-traditional benefits or functionality is the only way you’re going to make them more profitable. Top retailers like Costco, AAA, Amazon and Spotify understand this retailing principle, which is transferable to FIs if they will design and build their checking products like a retailer would instead of a banker.

For consumer checking financial performance on both the Small and Low relationship segments as well as the Super and Mass ones, a more detailed executive report is available if you’d like more information.