How Community Banks and Credit Unions Remain Relevant in an Increasingly Digital-Driven Sector

By Gregg Early

There’s no doubt that there’s a significant gap between the banking industry’s long-term strategic challenges before the pandemic and after the pandemic.

When branches shut down, traditional financial institutions only had their existing digital banking infrastructure to rely upon. And sometimes, it was just the bare minimum.

I remember calling a local credit union to open a business account during that time. There was no way to apply for an account online. And when I called the bank to see how I could open an account, I was told no one was available to meet in person. When I asked how long it might be before I could schedule an appointment, I was told they had no idea.

In most sectors, turning away business - especially when business was slow - isn’t a good business strategy. And it was evident that this credit union was significantly unprepared for conducting simple business on a digital level.

But the challenges for smaller financial institutions (FIs) hardly begins or ends with digital transformation.

Revenue recession is a more fundamental daily concern, because unlike VC-powered fintechs and neobanks where success is measured in growth rates (even if they’re bleeding money), FIs have real-world issues to manage, like maintaining rising earnings per share growth.

Traditional FIs can’t abide by “build it and they will come”. They have longstanding financial obligations in their communities.

While fintechs can reverse engineer an entirely different relationship with customers to maximize onboarding, traditional FIs have to deploy their resources to a broader array of priorities.

Goldilocks - and Occam’s Razor - Had It Right

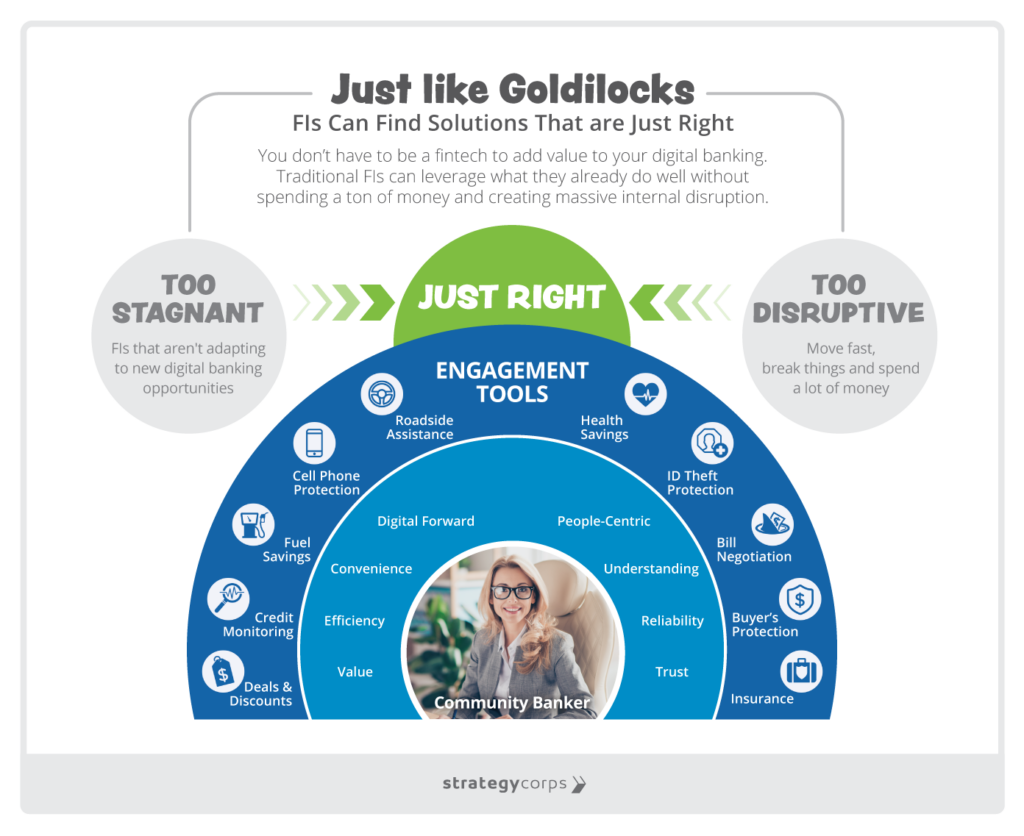

So, the challenge for community FIs remains finding a way to leverage their decades-long community ties and knowledge with digital banking features that add value for both customers and members, as well as provide revenue opportunities for the FIs.

And of course, accomplish this without spending a ton of money and creating massive internal disruptions.

To solve this “Goldilocks Challenge” we can take some inspiration from Occam’s Razor. This idea is linked to a 14th Century monk and basically it states that the simplest solution is the best solution.

In this case, it means there’s no reason to think about significant digital disruption when you can add significant value to current customers and members with a couple simple modern engagement tools.

Subscription Revenue

One thing that has happened across the digital transformation of our economy is the recurring monthly charge for services. Whether it’s Netflix, Amazon Prime, Spotify, or Revolut, subscription services are rapidly supplanting fees in the minds of consumers.

Traditional FIs remain wedded to fees and that has become a challenge since many fees are under pressure.

Creating value with subscription services above and beyond basic banking services can be a boon for renewed recurring income streams.

For example, our BaZing subscription product offers valuable access to roadside protection, mobile phone insurance, gasoline discounts, local store discounts, and similar financial products. The plans can be attached to checking accounts as a small fee or simply embedded as value-added features for primary accountholders.

With more than 300 FIs using BaZing, we see that for every $1 billion in assets, BaZing adds about $500,000 in revenue.

Growing Primary Accounts

But it’s only possible to create value if you’re addressing the customers and members that are likely to respond to offers to deepen their relationships. That’s what primary accounts are all about.

Another solution that has been very valuable is CheckingScore. This solution examines account data FIs already have on hand and finds out who their best customers are, who can be transitioned to primary customers and who are costing the FI money every year.

These solutions are built for community banks and credit unions to implement without having to reinvent the entire identity of the financial institution or being forced to undergo huge investments in new digital infrastructure or personnel.

It’s a way to combine the best of both worlds - a new level of digital products that can be offered as market differentiators to community FIs.

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, and Businessweek.