Adapt or Die Is More Than Metaphor in This New Digital Banking World

By Gregg Early

There is no doubt that the banking and financial services industry has transformed significantly since 2008.

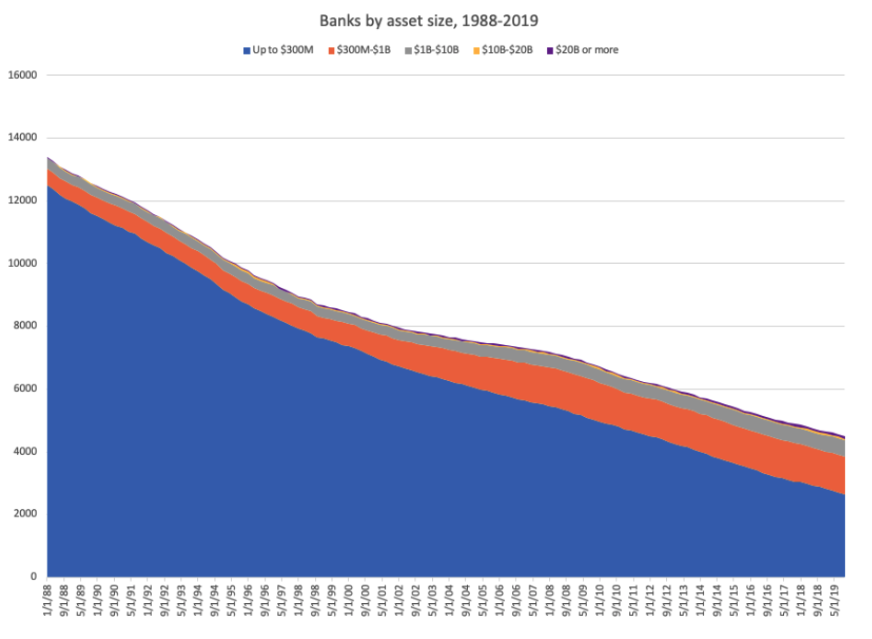

On a broader scale you can see from the chart below that the only asset size that’s really gaining any ground in recent years are the mega banks.

Source: Next City

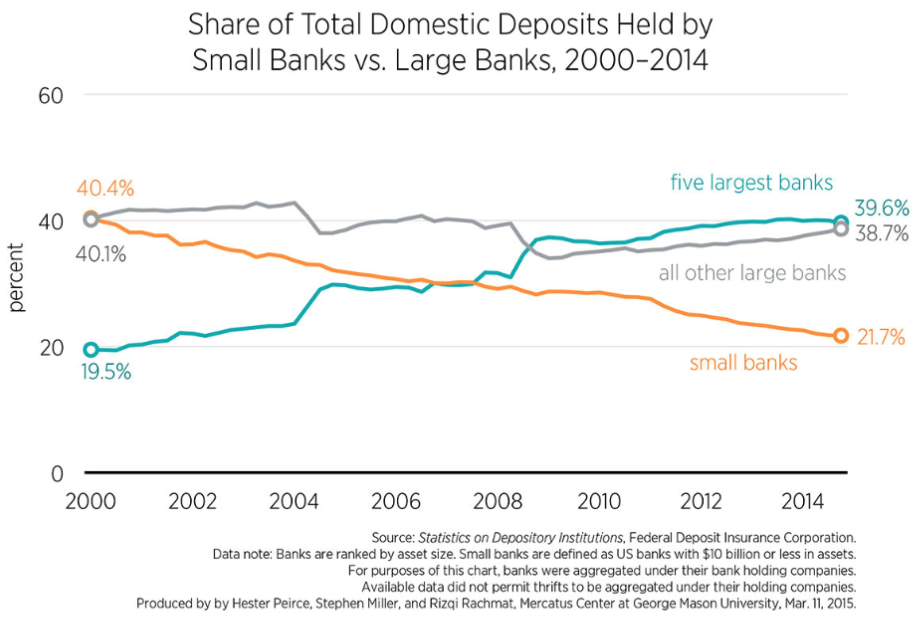

And no community bank or credit union has to be told that the competition is heating up, even without considering the challenges from neobanks, fintechs and embedded finance companies.

Source: Mercatus Center

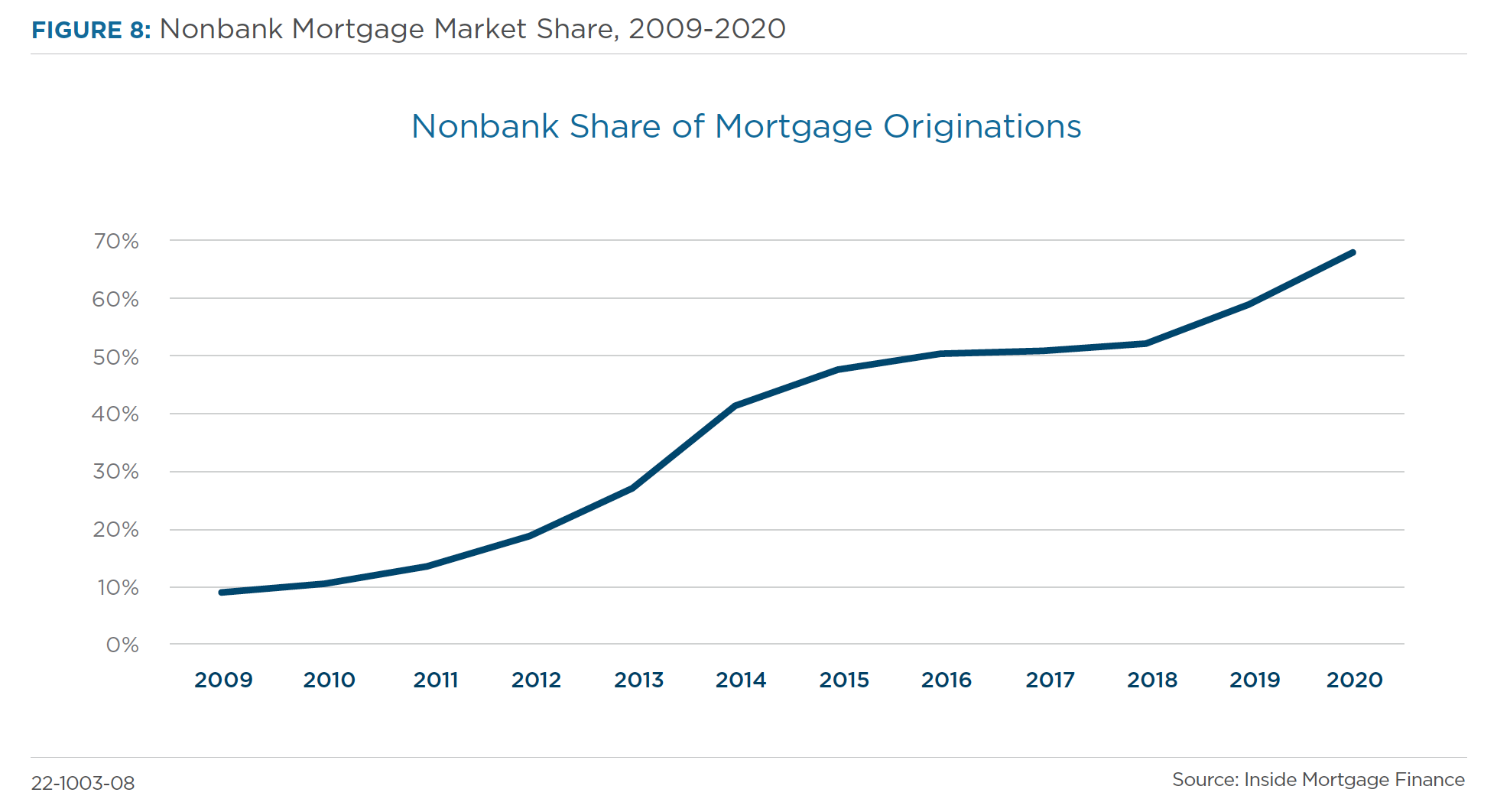

There are also other competitive challenges out there right now that are continuing to affect the ability of legacy financial institutions (FIs) to hold and even gain ground.

Net interest margin, the lifeblood of banks, has certainly been helped by rising interest rates, but gain on sale has been hit in the process. And the non-bank share of mortgage originations has exploded with the growth of fintechs and neobanks.

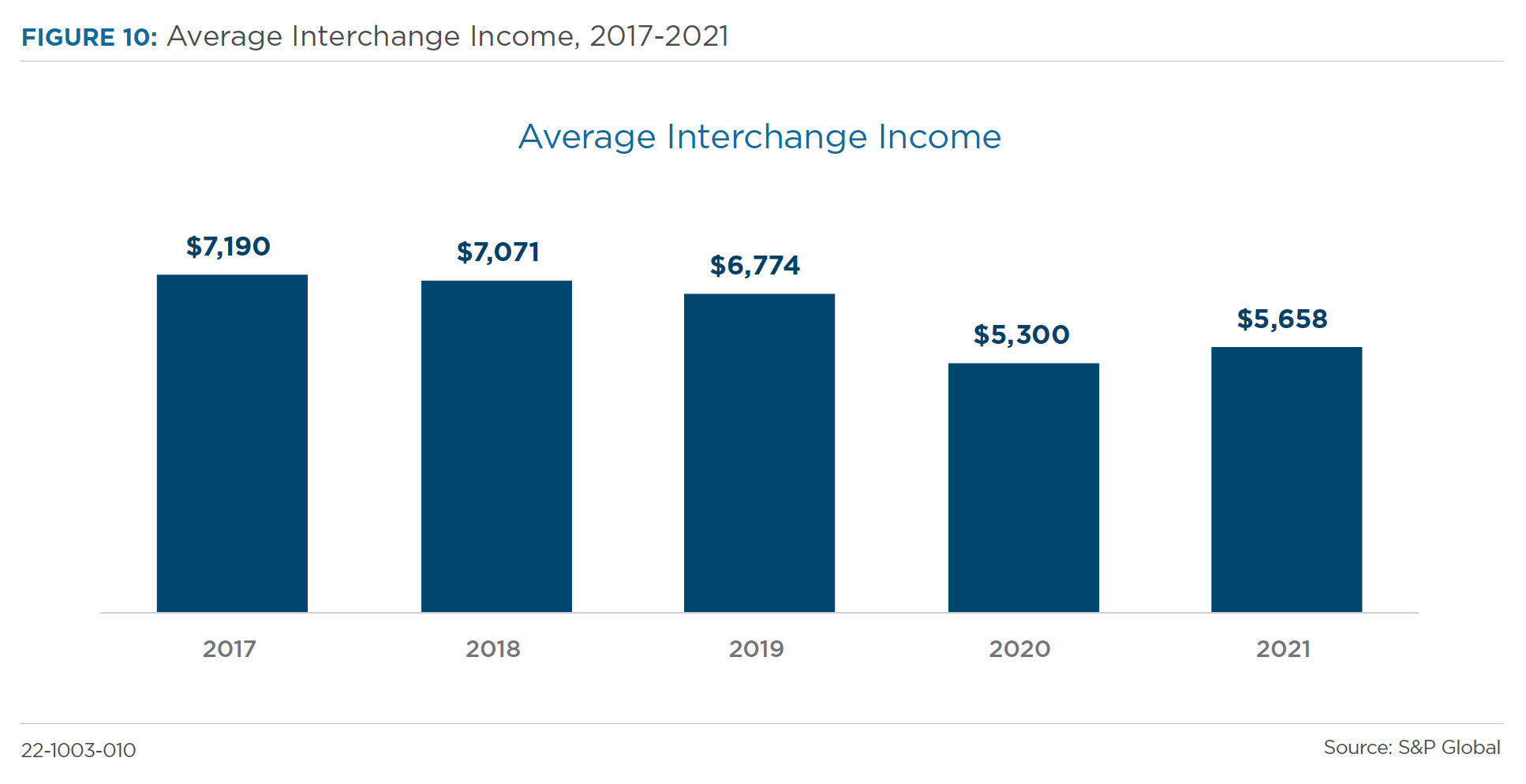

Also, these new competitors have challenged legacy banks’ fee structures. Both fintechs as well as the big banks are reducing or eliminating checking, overdraft and non-sufficient funds fees, which have been reliable sources of income for smaller FIs.

Another challenge that digital banking and financial services have brought with them is waning interchange income. New methods of payments and new services like cryptocurrencies and buy now pay later (BNPL) have accelerated this issue.

For example, in our recent research paper Creating a Fintech Subscription Engine with Ron Shevlin and his Cornerstone Advisors’ research team, nearly 30% of Apple Pay users and 40% of Google Pay users link a debit or credit card from a provider other than their primary bank, often displacing payments to challenger banks. Square’s Cash App is displacing payments, as well. Square reported annual Cash Card payment volume of $3 billion in 2018, and the year-over-year increase in non-Bitcoin Cash App revenue indicates that spending is on a strong trajectory, further cannibalizing payments volume on bank-issued cards.

Where Does that Leave Traditional Banking?

This may sound like a grim picture, but all is not lost for the community FIs. They have a number of strengths that can help them weather this digital banking storm.

First they have the power of their local markets. Many have been doing business in a city or region for decades and they have strong ties to the people and businesses in that community. That “personal touch” is absolutely vital, even in today’s digital banking age.

A number of studies show that even Gen Z and Millennial digital natives find talking to real people in their communities a distinct advantage when applying for loans and mortgages.

While younger generations are very keen on digital technologies, they also want to feel like they’re unique. That’s a challenge for big banks that move staff from location to location on a regular basis and don't have a strong connection with smaller communities.

Also, community FIs have the advantage of durability. They have been operating for years or decades, and aren’t working from venture capital that until recently has allowed many high-flying fintechs to operate without regard to the bottom line.

Now, however, that lead from their investors has gotten much shorter and many have fallen by the wayside.

FIs have parried the first wave of digital newcomers. And now is the time to take advantage.

Legacy Banking and the Art of Judo

But the key to success for community FIs lies in their ability to learn from what has happened in the financial sector in the past few years.

As you know, judo is a martial art that focuses on using your opponent’s offensive energy against them.

That is where traditional FIs are with fintechs. They can now use the tools that have been successfully developed by their competitors against them.

And one of the most powerful tools is creating a subscription revenue model. That means adding valuable services to subscribers beyond just banking services as part of a subscription service instead of, or as part of, traditional service fees.

To find out more about how this new subscription revenue model - aka, embedded fintech - works, download a free copy of our detailed report, Creating a Fintech Subscription Engine. The 28-page report details the challenges and the opportunities that community banks and credit unions need to start thinking about in this new and exciting time for financial services.

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, and Businessweek.