What the Rise of Embedded Fintech Means for Community Banks and Credit Unions

By Gregg Early

Since “The Rise of the Fintechs,” a lot of terminology has been thrown into circulation. Some doesn’t last more than a few months, some is in continual flux. And other terms start to mature and redefine themselves.

That’s where we find ourselves with “embedded fintech.”

Not so long ago, the most common version of this term was “embedded finance.”

First, What’s Embedded Finance?

Basically, embedded finance was part and parcel to the unbundling of financial services that fintechs have been doing for years. Banks and credit unions have spent their entire existence (until relatively recently) bundling financial products and transactions so they could be a one-stop shop for customers or members.

They could then generate revenue from more sources - lending, interchange fees, account fees, Treasury management, etc. - to diversify their income streams. And given the regulatory barriers in place, their only competitors were other financial institutions since the regulations created significant barriers to entry.

But former banking execs and others were starting to realize that financial services companies were left to absorb the new massive transitions the digital economy was having on every other business sector without much outside competitive pressure.

We saw e-commerce completely transform the retail space. We’re still grasping the challenges and advantages of remote work in the modern workplace. And that includes all the real estate many corporations are sitting on now that has fewer to no tenants.

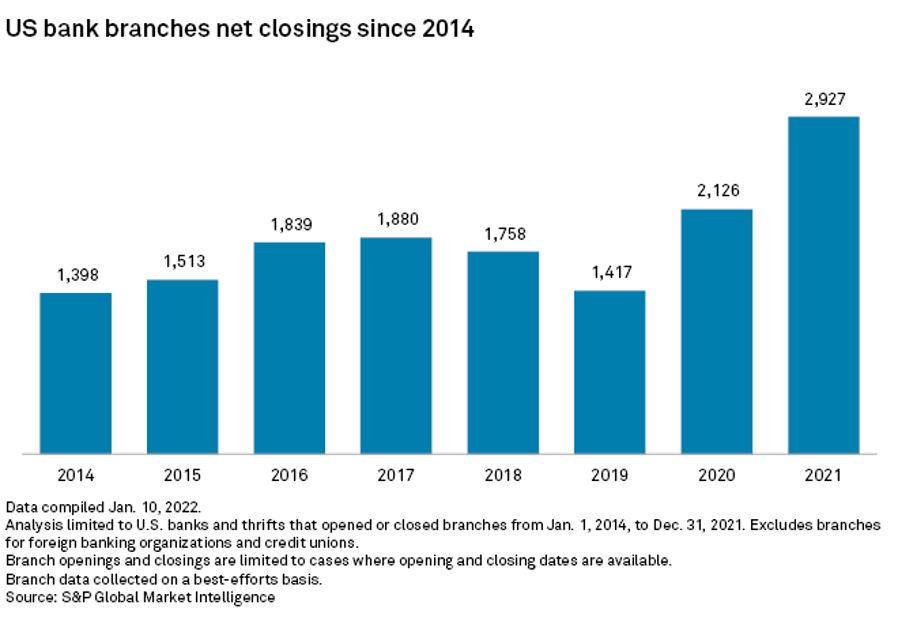

In the banking industry, you can understand this trend best by looking at bank branch closures.

Also, demographic shifts - Gen Z and Millennials represent almost 170 million US consumers - mean that digital natives are now in prime demographics for consumers of all retail products, from make-up, to movies, to savings accounts.

This challenge was taken up by digital-first companies like Amazon and Netflix. Unbundling financial services meant they could be rebundled into more diverse product platforms. Siloes were merging.

And recurring revenue became the new coin of the realm. That certainly appealed to Wall Street since it meant more stable revenue streams, which meant more predictability. And for retailers it meant smoothing the business cycle since a base of cash flow was moving through the company all the time.

So, What’s Embedded Fintech?

Applying this logic to financial services was simply the next logical step. And examples of what has become known as embedded finance is everywhere now. Amazon has its Prime subscription service. Google and Apple both have payment platforms and growing rewards and features beyond simply a place to park cash.

And scores of the companies are now adopting embedded finance. But that’s just one more competitor for banks and credit unions on top of the fintechs, neobanks, BNPL firms, and digital loan platforms.

While this has all been unfolding, a new opportunity for financial institutions has cropped up. It’s called embedded fintech.

The easiest way to understand it is, after all the unbundling was done by fintechs it’s now a great opportunity for financial institutions to beat fintechs at their own game.

Instead of FIs searching for potential consumer and digital partners to bundle into a broader service like embedded finance, FIs can create their own bundles of valuable features that extend beyond the traditional banking siloes.

Banks and credit unions can offer tiers of unique features that fintechs provide - subscription management, best-price tools, phone insurance, retail discounts nationally and locally - and create their own subscription-based revenue streams.

This is embedded fintech. And many community credit unions and banks have already adopted it to great success.

How Can Embedded Fintech Work for You?

At StrategyCorps, we’ve been building out embedded fintech since long before this recent rise to popularity. Our BaZing white label service specializes in getting community banks and credit unions into the digital game by doing the heavy lifting and creating a unique one-stop embedded fintech strategy and product.

Check out the recent free report StrategyCorps put together with the help of Cornerstone Advisors’ Director of Research Ron Shevlin and his team, Creating a Fintech Subscription Engine.

The report goes far beyond just discussing embedded fintech and gives an in-depth view of what’s happening in the financial services space and what banks and credit unions can expect in the near future.

Download the report here.

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, Businessweek.