Primacy: The Bigfoot of Banking

With the acceleration of digital banking, we’ve heard a lot about customer primacy (or primary account holders).

By Gregg Early

But as we asked bankers around the country about this, we seem to get a number of answers and non-answers. Almost to a person all of them say that maintaining and expanding primary accounts is crucial to growing their earnings per share.

However, when asked the next level question, “How do you define a primary customer?” we get all sorts of answers. Some say that it’s customers or members with an active checking account and debit card. Some say it’s customers or members with a checking account and a credit card. Some active checking and savings accounts. Some don’t really have an answer.

When push comes to shove, it seems the answer is as elusive as Bigfoot.

Beyond the “Cash Motel”

As the fintech and neobank surge was transitioning from curiosity to threat, Ron Shevlin of Cornerstone Advisors used the term “cash motel’’ for the traditional checking account.

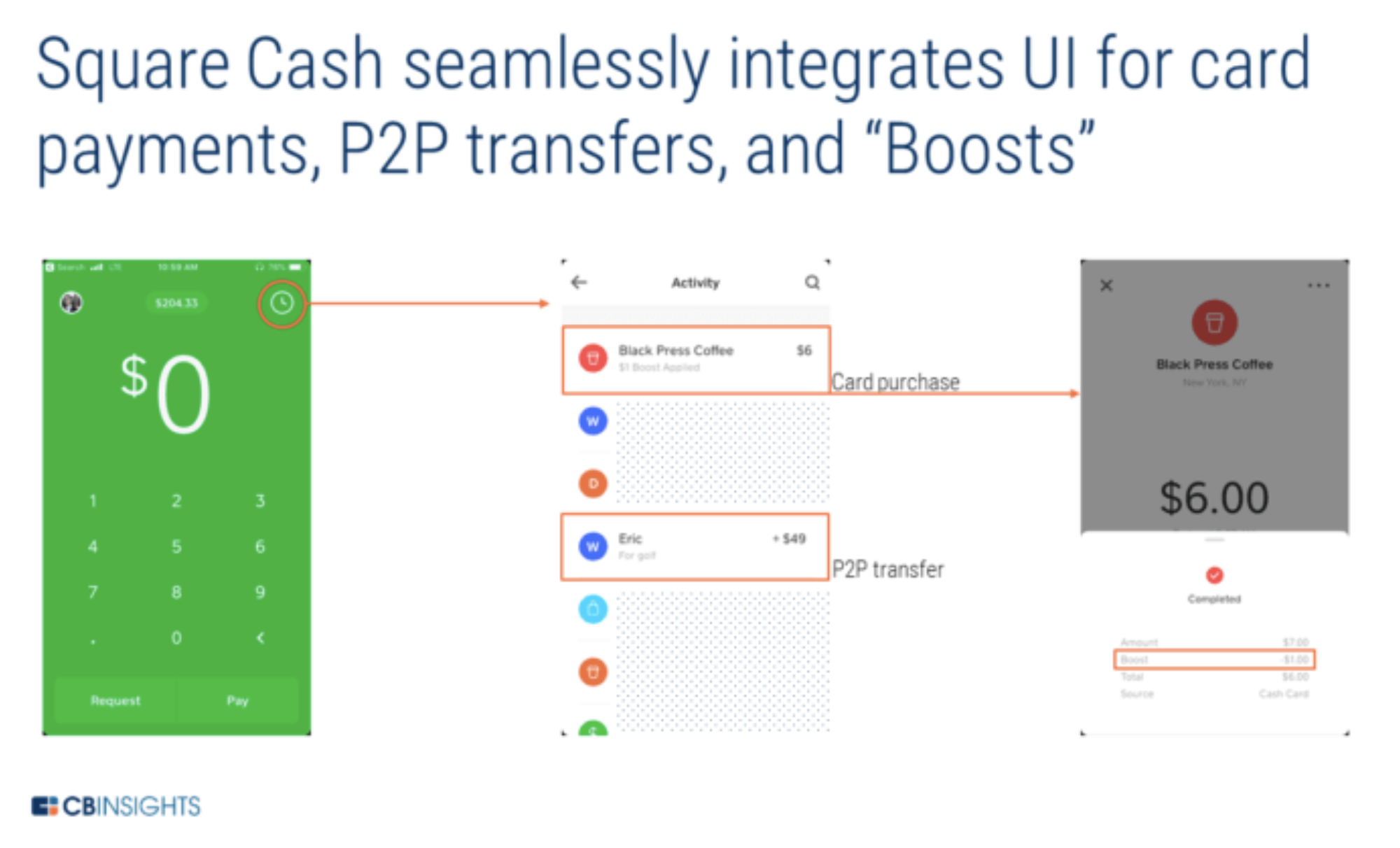

What he meant by this was that digital banking was reinventing the checking account into a more integrated account with other banking and financial services features. And instead of “paying for a room” to park your cash in a traditional account, digital banks were charging subscription fees for the ability to make a checking account more dynamic by linking seamlessly to other important consumer services.

Granted, legacy financial institutions have digital banking, but it’s usually a bit cumbersome and one dimensional. These bill pay systems are like saying that ATMs are part of a digital banking strategy in 2022.

But this is the real challenge as well.

Source: FintechBusinessWeekly.substack.com

Community banks and credit unions don’t have the kind of staffing and deep pockets to simply implement a new digital banking solution and completely revamp operations that have been delivering reliable, community-focused services for decades - or even centuries.

Community FIs aren’t ones to take leaps of faith. Like doctors, conservative gradualism is the safest and most prudent path.

And that isn’t a bad thing. Wading instead of jumping into the deep, fast water of digital banking shouldn’t be a rash, hastily considered decision. Reflection, and a pragmatic strategy is the wise course. Building a strategy that embraces practical tactical steps toward realistic short-, medium-, and long-term goals is the wise approach.

Take a Lesson from Fintechs, Intuit, and Amazon

One of the key reasons that fintechs became so popular so quickly was that their development timeline was accelerated by the pandemic.

Had bank branches not shut down and all human-driven interactions ceased, it would have been a much gentler transition from legacy banking to digital banking.

But that ship has sailed. We are where we are.

And fintechs, neo-banks, and non-banking entities had been examining the strengths and weaknesses of traditional banks for some time. And when their time came, they were ready to take advantage.

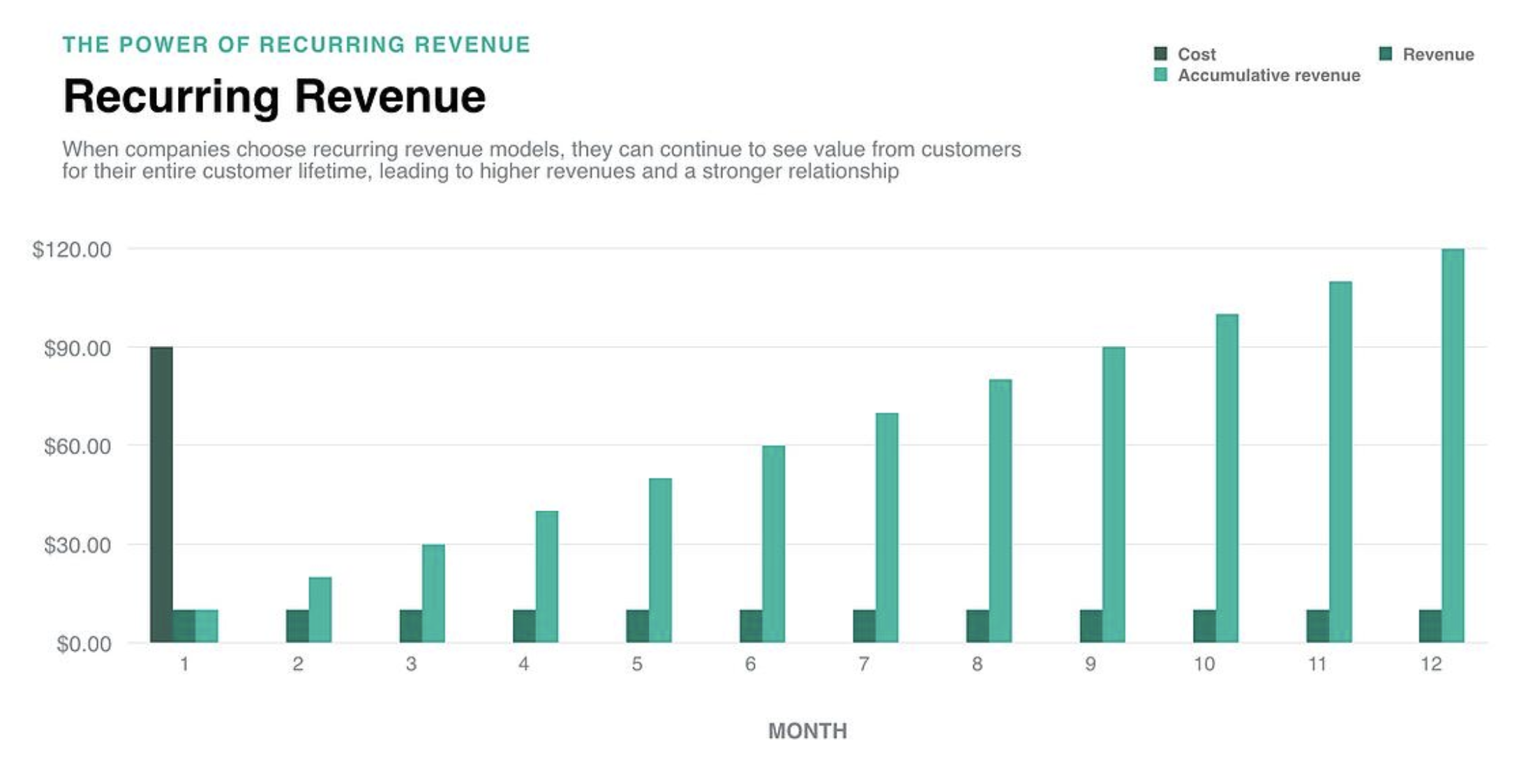

The model they moved forward with was something that had been launched decades earlier by tech firms like Intuit, Microsoft, and Amazon, to name a few. Subscription revenue.

Source: priceintelligently.com

The fintechs would drop typical banking fees like account, overdraft, and NSF fees and adopt a subscription model. They would also add much sleeker digital customer experiences and link in partners that would provide value for new subscribers.

This has taken banks by surprise and many have dropped some or all of these fees to compete without having a new revenue source.

In StrategyCorps’ recent report with Cornerstone Advisors, we explored the challenges community financial institutions are facing that present significant headwinds to maintaining and growing primary account holders.

For more, see StrategyCorps’ own Mike Branton and Dave Crook's webinar recording on proven steps to invigorate primary accounts and build banks and credit unions for the future without the financial and time commitments that many fintech solutions require.

Over the decades, StrategyCorps has been building this bridge to the future of banking. And the numbers speak for themselves, banks and credit unions using StrategyCorps’ subscription revenue model and primary account analysis are generating on average $500,000 per $1 billion in assets.

That may not change the game, but it certainly will help keep community FIs in the game as they evolve for the digital banking future.

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, and Businessweek.