Don’t Fight the Tape: Get Beyond Chasing New Deposits

While certainly an arrow in the quiver, community financial institutions can’t solely rely on growing deposits to thrive.

By Mike Branton and Gregg Early

It has been a wild ride for banks and credit unions. The shift from a low-growth, low interest rate environment to its complete opposite in less than 12 months has created significant turmoil for the entire sector, particularly with community financial institutions (FIs).

But returning to “normal” isn’t going to look at all like the status quo we’ve been in for the past 13 years. There’s a new normal taking shape and it means that community FIs need to find new ways to think about managing the risks and exploring new opportunities to compete in this environment.

Single mindedly hunting for new deposits is going to be an ineffective short-term effort that won’t alleviate significant long-term challenges that are transforming the financial sector.

The New World

Short term, the Fed and the FHLB opening their credit windows to allow community FIs the liquidity they needed to get them through staved off the worst of this first wave. However, as The Economist observes, we’re now entering an entirely new environment where size and scale matter to generate earnings to create sustainable value rather than just revenue growth:

“America’s banks are worth only about their combined book value, having traded at nearly a 40% premium at the start of the year. The likely result of their low valuations, combined with a landscape in which size matters, is a tried-and-tested response to banking crises over the past four decades: consolidation.”

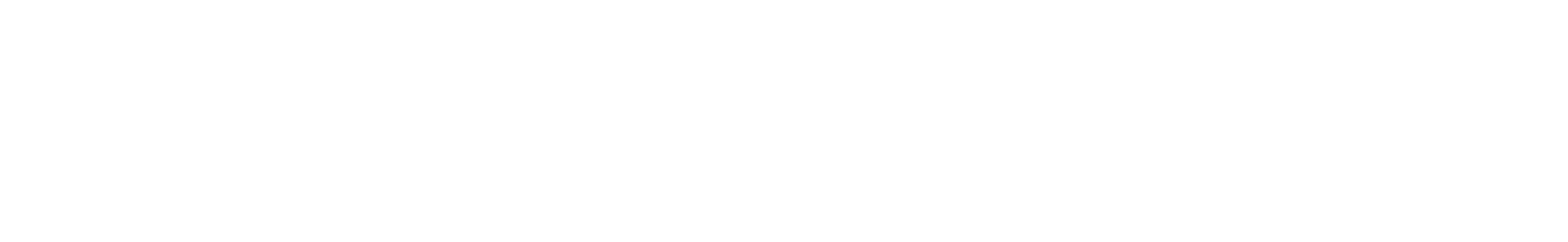

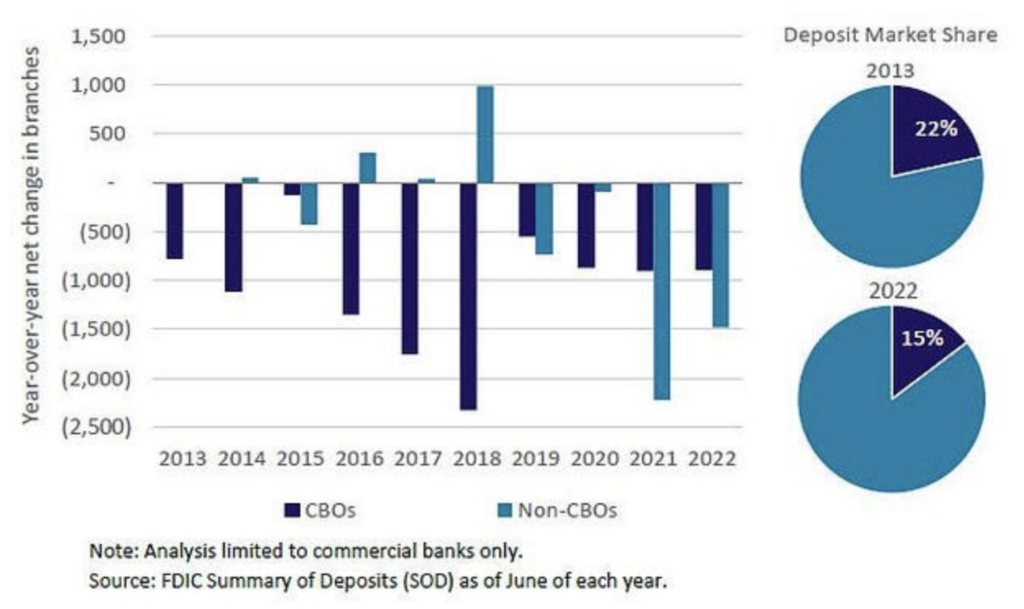

The biggest challenge for community FIs is the loss of deposits as many customers hunt for higher yields. Many community FIs have adopted growing deposits as their go-to strategy, yet the graph below shows this strategy has some significant headwinds:

Deposit pricing based on interest rates is now making deposit acquisition competition more difficult and expensive.

Digital banks are leading the way with high interest savings or checking accounts and are quickly (in some cases immediately) passing through interest rate increases paid on deposits due to Federal Reserve rate hikes. This is decreasing the lag time between the interest rate adjustment for loans and deposits that banks depended on for a NIM earnings boost.

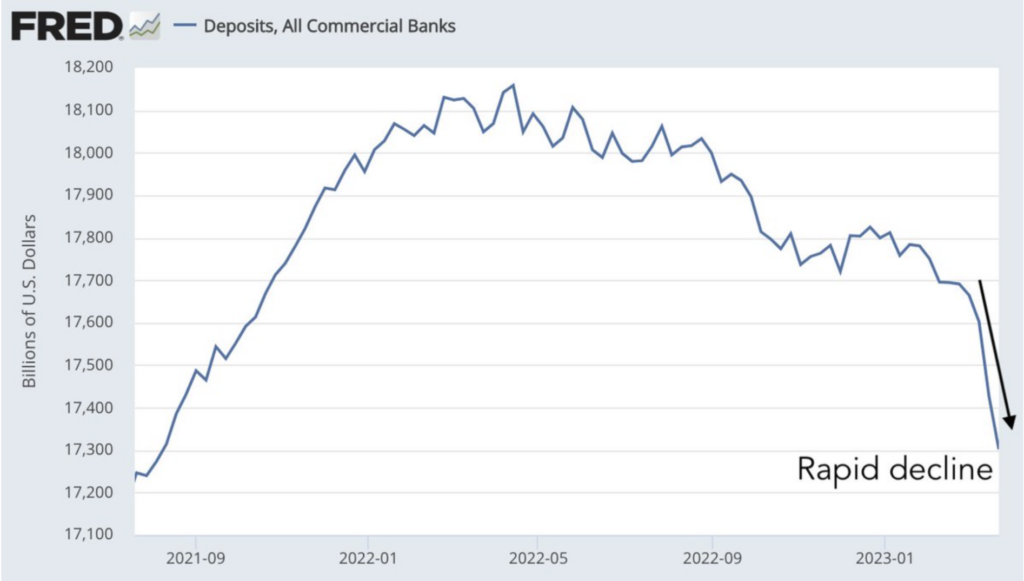

As we can see below, demand for loans is also making this more difficult.

This is putting significant pressure on market share for community FIs from a consumer confidence perspective as well as a rate perspective.

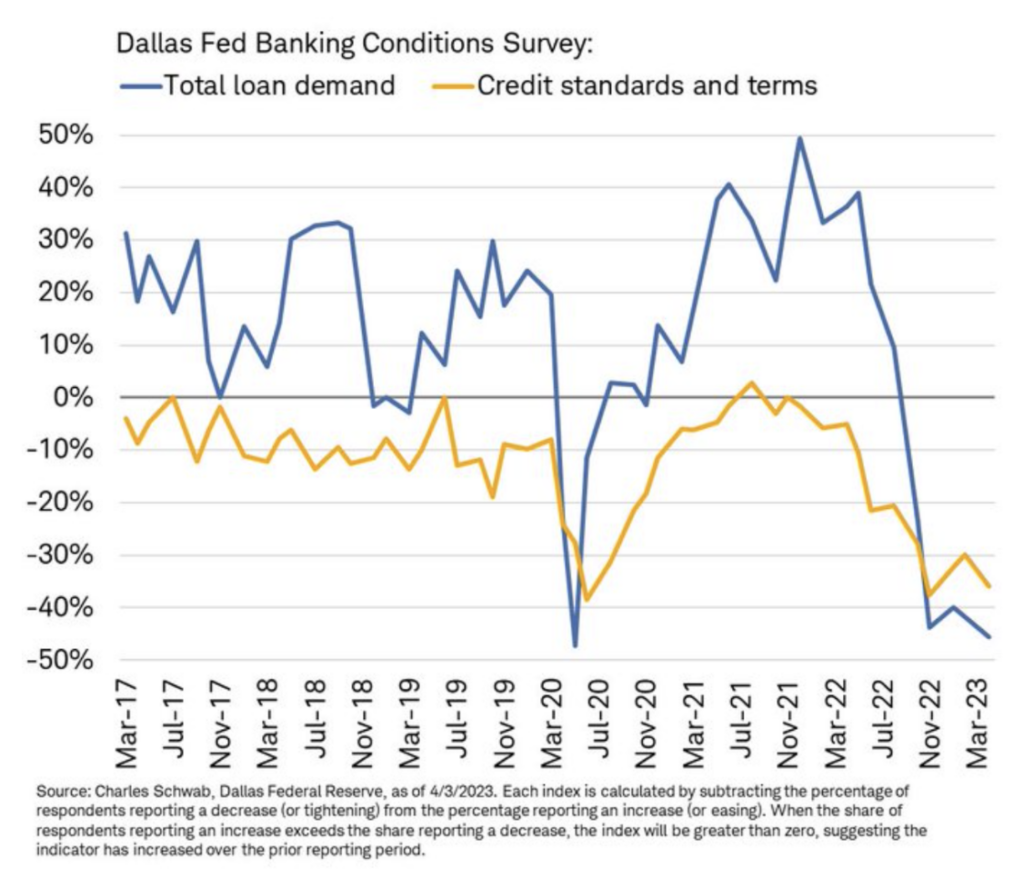

And if you overlay these graphs with the KBW Regional Banking Index, you can see how it has been reflected by the markets:

Unsurprisingly, this is directly reflected in market share for community FIs as well.

Community banks and credit unions only have about 15% of the total deposit market share. Deposit market share is dominated by the top 150 largest banks and of this group, the largest 4 mega banks.

A New Challenge

And if pressure from large FIs weren’t enough, now there are digital players in the mix.

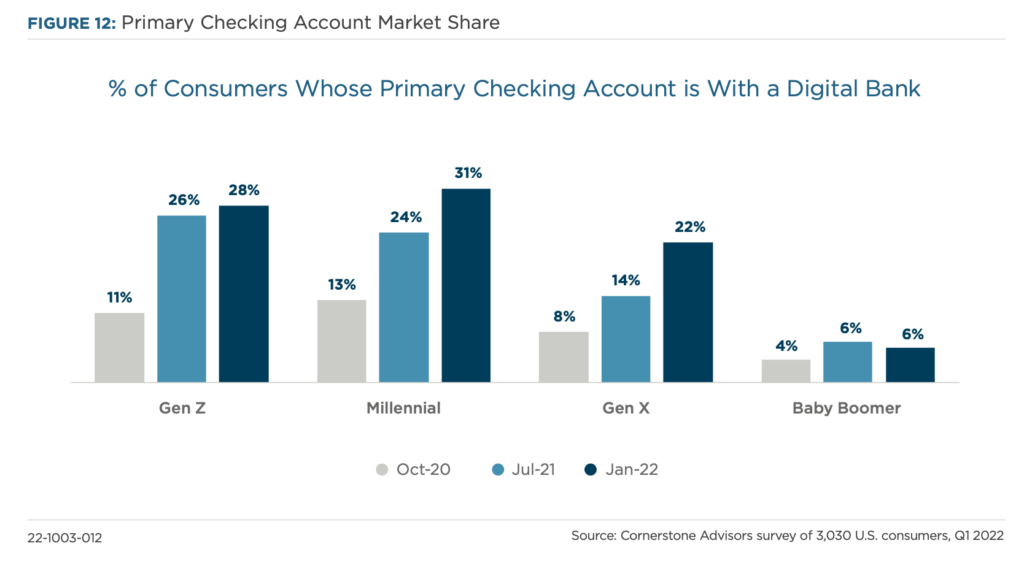

Consumers across all demographics who are switching primary FI relationships are flocking to the larger banks, especially the mega banks, and digital banks.

What’s more, only 11% of consumers are looking to change primary banks annually and for those that are, they’re choosing digital banks like never before. For the first time ever, in every major demographic, more consumers identify their primary FI as a digital bank rather than a traditional one. That only adds to the competitive pressure on community FIs.

The New Bottom Line

Suffice it to say, most community FIs can’t compete on price, scale or marketing prowess versus the mega banks or digital ones. They’re outgunned in terms of new customer acquisition and trying to retain their best customers/members from moving to one of these types of FIs.

For community and smaller regional banks and credit unions (under $50 billion in assets in particular) to meet the goals of their top priority of retail deposit growth, they must invest in product differentiation that attracts the attention of consumers in terms of relevant value to their lifestyles beyond banking.

This means these products must be consumer appealing while also being versatile in terms of revenue generation - particularly products that generate recurring, consumer-friendly non-interest income that’s value-based and not penalty-based.

Also they need to develop acquisition marketing programs that are highly targeted and offer unique, differentiated and more valuable products, and a robust “account rounding” sales strategy to get more deposits and relationships from existing customers/members to complement the net new deposits from new customers/members.

Banking has changed and it’s important that community FIs understand that this isn’t going to simply blow over.

This doesn’t mean that they have to abandon their prudent, conservative financial discipline and swing for the new digital fences, but it does mean there needs to be more adaptation to the new normal than simply relying on the tried and true approaches of the past to solve the real challenges of the present.

For more information on how StrategyCorps solutions can provide a bridge to a new approach to building value for customers/members and growing primary accounts, primary accounts, feel free to contact us.

Mike Branton is a financial expert and partner at StrategyCorps. You can connect with him at mike.branton@strategycorps.com

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, and Businessweek.