Evolution Can Be More Dangerous than Revolution: Digital Adoption for US Banks and Credit Unions

By Adam Thompson

While there’s a lot of talk about industry or technology revolution, the fact is it’s generally evolution that transforms an industry and lays waste to stragglers and the stubborn.

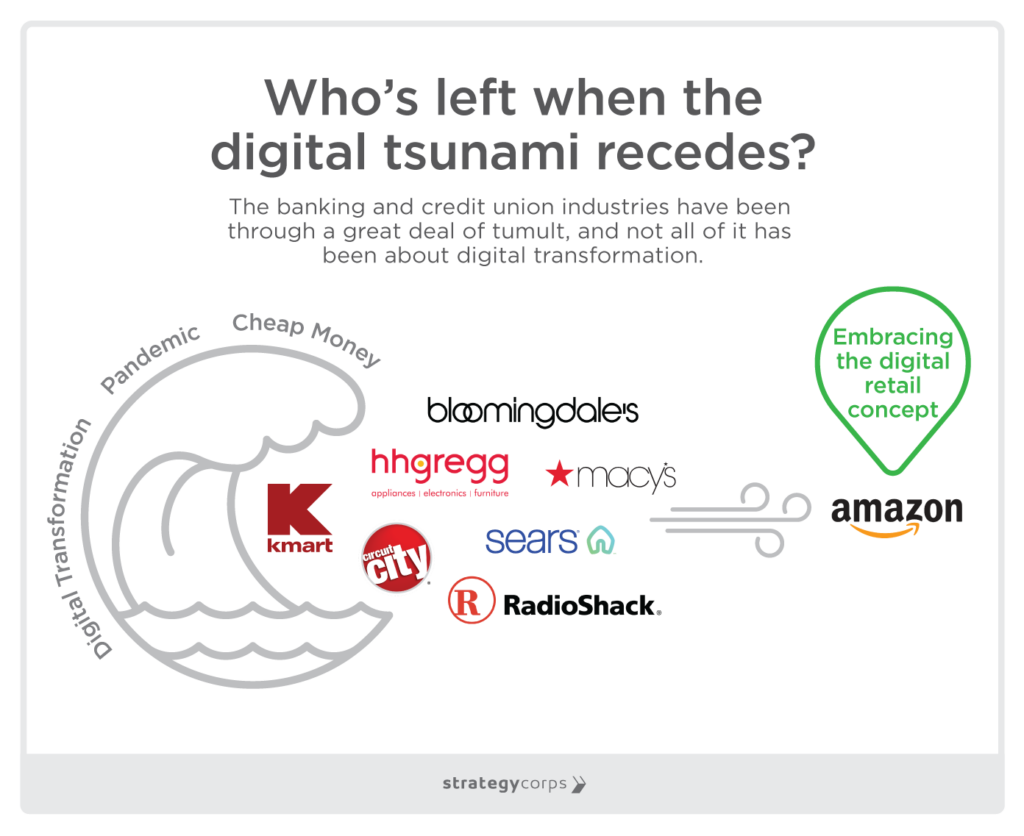

One industry where we can see what digital evolution has done is in consumer retail. At the turn of the century, major department stores were the anchors of consumer retail.

No one would consider building a shopping mall (remember them?) without one or two major retailers to draw the crowds.

But Amazon.com changed all that. Whether it was solid legacy names like Sears or Kmart, or upscale brands like Bloomingdales or Macy’s, businesses that thought they could outlast, outspend, or simply ignore this new digital retail “fad” hardly even bothered exploring the digital retail concept. Until it was too late.

Even specialized retailers like Circuit City, Radio Shack, and HH Gregg fell victim. Best Buy barely survived, like Macy’s only by putting forth an enormous effort to rethink their branches and invest in a valuable digital experience.

The Challenge: Evolution, Not Revolution

There’s no doubt that in the past two decades the banking and credit union industries have been through a great deal of tumult, and not all of it has been about digital transformation.

But the pandemic and the massive amounts of cheap, easy money that venture capital and investment bankers had access to, drove a massive effort to transform legacy banking.

As that tsunami recedes it has caused some damage to legacy banks, to be sure. It’s not the end of the world for the status quo – but you can see it from here.

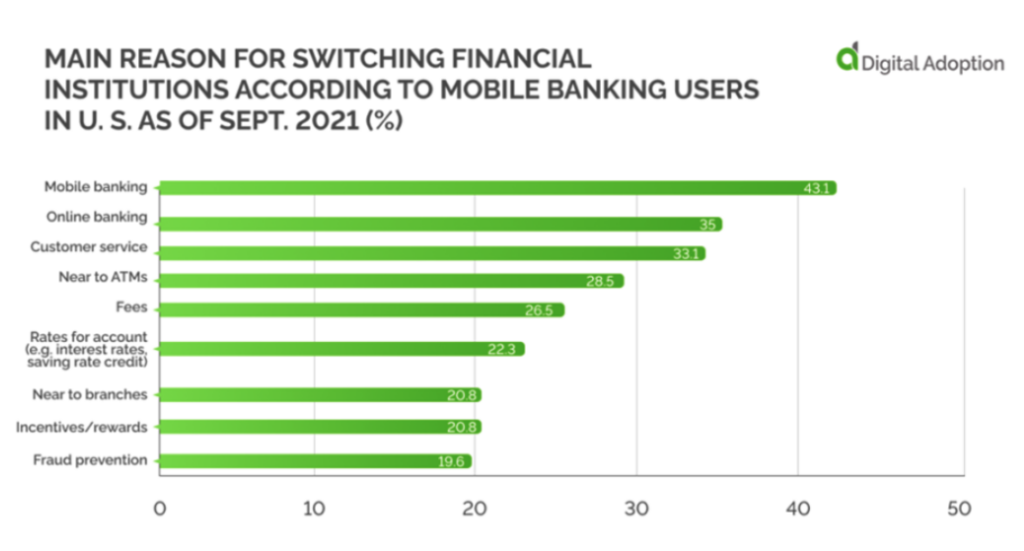

A study done in September 2021 by digital-adoption.com reveals that of customers who switched financial institutions (FIs), more than 40% said that mobile banking was the reason for the switch, followed by 35% who changed their banks for online banking.

This is clearly customer- and member-driven demand for change.

Of course, part of the reason this is happening is because almost everything at this point has some kind of digital analogue. When Apple ran its earworm campaign for the iPhone – “there’s an app for that” – who knew that a decade later it would be literally true for virtually every industry.

And the banking industry is no exception.

Read the Room

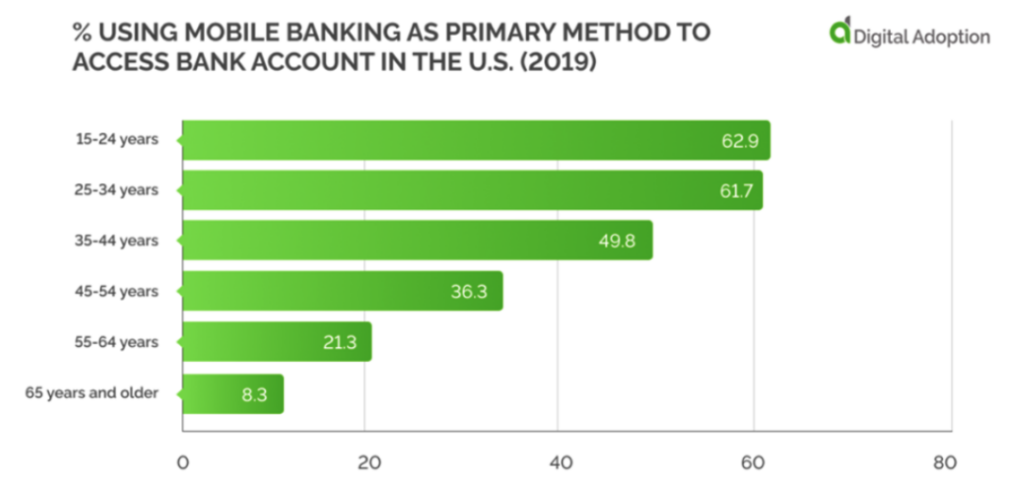

There are more than 200 million people in the US – Gen X, millennials, Zoomers – that are digital natives. And the younger generations live on their phones, which have become powerful handheld computers linked to incredibly powerful mobile networks.

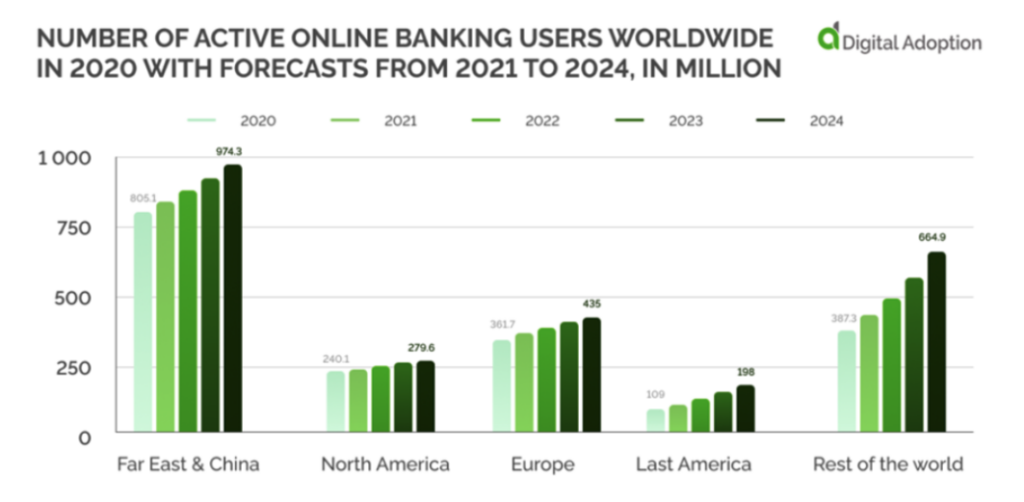

And the crazy thing is, the US is lagging behind other regions of the world in digital adoption of banking services. The possibilities for growth in this sector are enormous.

The US also has slower average connectivity speeds, which may account for some of the subdued adoption numbers.

However, some of it falls at the feet of legacy banks and credit unions that aren’t implementing enriched digital solutions for their customers and members.

Now Is the Time

Certainly, the big national banks are deploying massive amounts of money to reinvent the banking experience. New lobby ideas, in-house digital banking teams, and state of the art apps.

But smaller FIs don’t have the resources to drive this digital adoption at such a scale.

That’s all right.

It isn’t about delivering a complete transformation and putting the legacy business at risk. But it is about beginning to move down the road with real efforts and products to show customers and members that your FI is heading in the right direction.

There are ways to make your data more actionable. There are proven solutions that can revitalize primary accounts for current and prospective clients. There are ways to transition from punitive fees – which are also on their way to the dustbin of history - to rewarding renewal revenue models.

Now is also the time for community banks and credit unions to reimagine how to create more value from their branches.

And given the fact that net interest margins and earnings are growing for many FIs, and competition from neobanks and fintechs is in abeyance for now, this is the time to develop an action plan.

Because as the unrelenting waves of digital challenger banks roll in, those FIs that continue to sit on their hands hoping for the best won’t be swept away, but may well be eroded away.

Adam Thompson is Director of Sales at StrategyCorps.