5 Steps to Up Your Engagement Marketing Efforts

Attract and retain consumers with engaging benefits and a plan to educate people about it

By Trae Turner

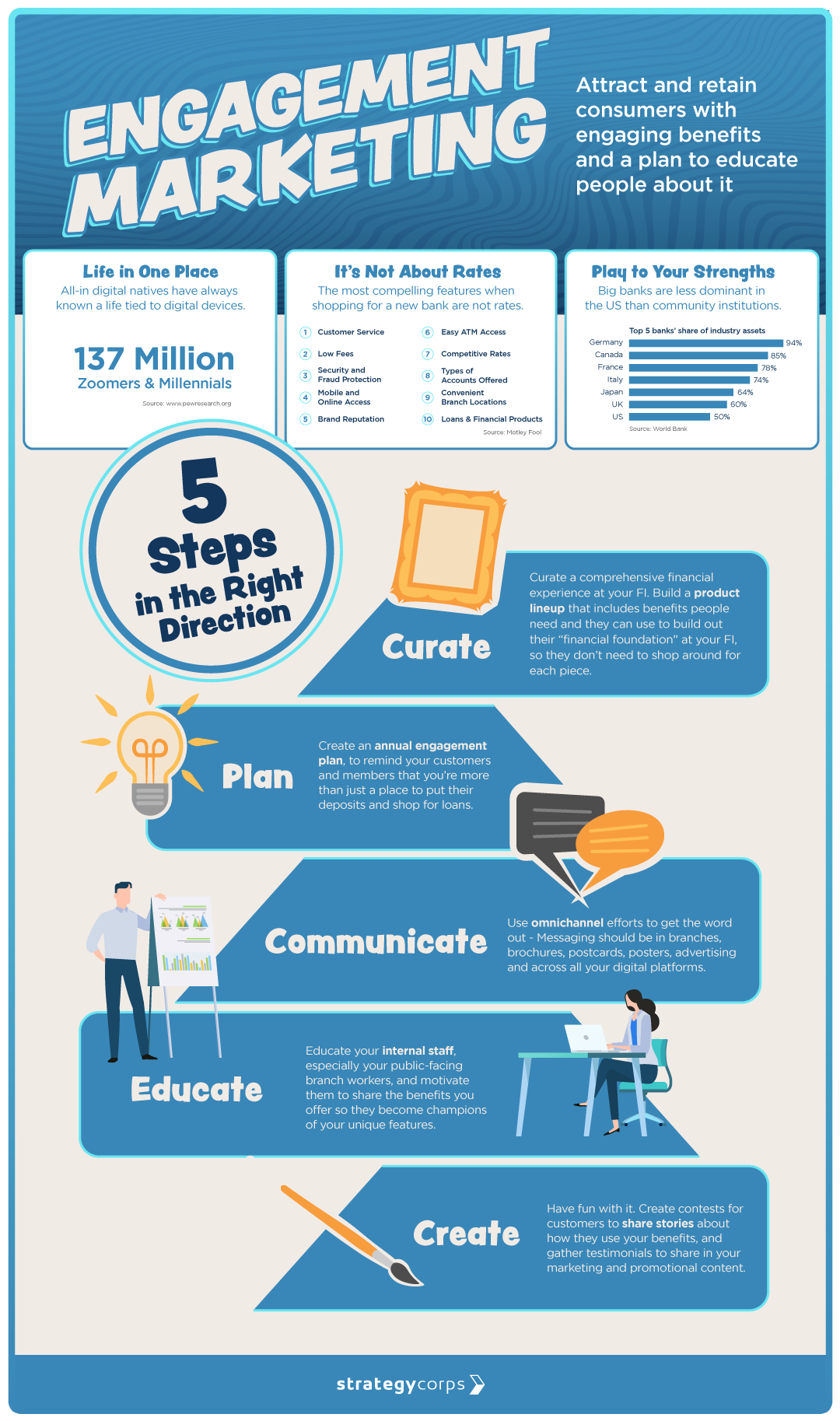

It’s not breaking news that people’s lives are tied to their mobile devices. Look around. Whether it’s a phone, tablet or laptop, it seems wherever you go, people are incorporating their lives in one place - digital devices. And this is especially true of the 137 million Zoomers and millennials who are all-in digital natives.

So, the question becomes, if everyone wants “life in one place” why not keep fulfilling that desire when it comes to creating banking relationships with customers and members?

It’s Not About Rates

In a study from Motley Fool, they polled 1,700 banking customers to see what were the most compelling features they looked for when shopping for a new bank.

Of the top 10 reasons, interest rates was No. 7. And this poll was taken in December of last year.

The No. 1 reason? The quality of customer services. No. 2 was low fees.

This is why it’s crucial that community banks and credit unions deliver on their strongest features - knowing their customers/members and delivering a personal touch, whether in person or digitally.

Play to Your Strengths

Also bear in mind that community financial institutions alway rank highest when it comes to consumers’ trust. Another recent study underscored their popularity. It showed that of developed countries, where 90+% of the population had bank accounts, the US’s top 5 banks held about 50% market share. That’s lower than any other developed nation.

Community banks and credit unions are significant players in the lives of Americans, even as digital banking starts to transform the industry.

That’s why it’s important to remember that community FIs already have what it takes to compete in a digital world. And as banking evolves to new circumstances, they can also use this evolution to their advantage by offering “banking in one place”.

That’s at the heart of a solid engagement marketing strategy. It’s the best way to create a year-round engagement plan to attract people to your FI and retain your current account holders.

5 Steps in the Right Direction

- Curate a comprehensive financial experience at your FI. Build a product lineup that includes benefits people need and they can use to build out their “financial foundation” at your FI, so they don’t need to shop around for each piece.

- Create an annual engagement plan, to remind your customers and members that you’re more than just a place to put their deposits and shop for loans.

- Use omnichannel efforts to get the word out - Messaging should be in branches, brochures, postcards, posters, advertising and across all your digital platforms

- Educate your internal staff, especially your public-facing branch workers, and motivate them to share the benefits you offer so they become champions of your unique features.

- Have fun with it. Create contests for customers or members to share stories about how they use your benefits, and gather testimonials to share in your marketing and promotional content.

You’re Ready for Engagement Marketing Now

Once you have those pieces in place, you’re ready to build out your full spectrum engagement marketing campaigns!

Here’s a breakdown of what that might look like:

- Start with an overall engagement campaign, then plan for continual efforts on a quarterly basis.

- Themes based on customer benefits, such as “wellness” for healthcare savings; “family fun” for concert tickets, restaurants, theme parks; “travel” for roadside assistance, gas discounts, as well as national and local food discounts, etc.

- Omnichannel works best: That means emails, social media, web ads and content (blogs, etc.), print and electronic newsletter, and in-branch materials like brochures, signage and postcards.

Finally, let everyone know about the benefits your accounts offer, and remind people who already have accounts about the benefits they have access to.

To learn more about how StrategyCorps can help with your engagement banking, contact Trae Turner, Marketing Manager at trae.turner@strategycorps.com

Trae Turner, StrategyCorps Marketing Manager, has helped financial institutions create and implement successful engagement marketing strategies with fintechs like Geezeo, Jack Henry, and Zelle.