Give Your SMB Accounts What They Need Most: Information Security Tools

By James Mason

It’s very likely that if you ask any SMB owner what their biggest threat to running their business is today, information security, cyber attacks (and liability for attacks), and ID theft will be the ones at the top of their list.

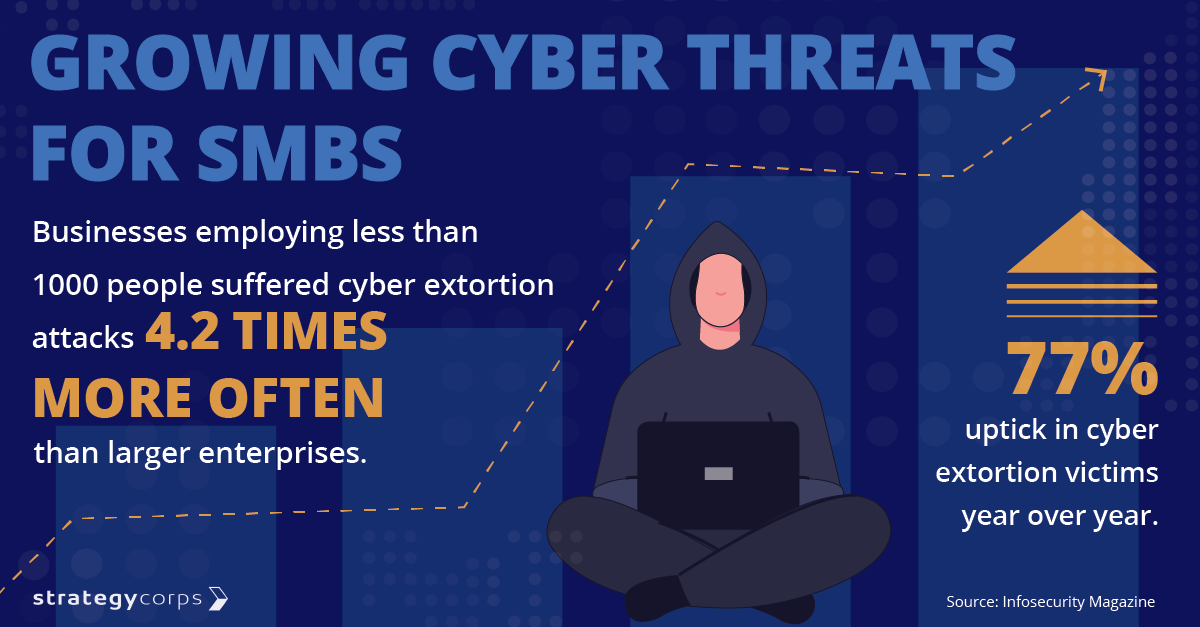

According to Infosecurity Magazine and Orange Cyber Defense, there’s a 77% uptick in cyber extortion victims year over year. And “companies employing less than 1000 people, classed as small and medium businesses (SMBs), suffered cyber extortion attacks 4.2 times more often than larger enterprises.”

According to the Identity Theft Resource Center, 42% of small businesses lost revenue due to a cyber event in 2023. And more businesses saw other increased impacts from the previous year, such as more customers losing trust in the business (32%).

The gains from today's digital operating platforms SMBs employ have a downside - exposing customers and systems to "bad players".This only adds to the strain that many SMBs are feeling in this economy.

The most recent - and disturbing - example of this is the AT&T hack. In a six month period in 2022, cybercriminals made off with the phone and text records of 110 million customers. And this is one of the major telecommunications firms in the world, with the means and motivation to keep their systems secure.

SMBs have neither the budget nor personnel to provide that kind of security.

That’s why it’s crucial for community FIs to offer cyber and ID theft protection to SMBs and their key customers/members. Plus, competitively this protection differentiates from the megabanks and digital banks that are taking SMB market share from traditional regional and community FIs.

This means there’s an opportunity for community FIs to offer help in keeping their accounts secure and their money safe.

Account security is already something that customers/members expect their FIs to monitor on their end. But SMBs, if given the proper digital tools to watch their accounts for any mysterious charges or subscriptions, can alert the FI if any unusual events show up in their accounts.

FIs that offer real products to help SMBs protect themselves and their customers can have distinct downstream benefits, like improved primacy. And it can be a significant differentiator from the competition.

“Most financial institutions enjoy the reputation of being a trusted organization when it comes to data privacy and protection. As a result, they are perfectly positioned to empower customers with tools that can help reduce the risks posed by data breaches and the fraud and cybercrimes that occur in their wake,” explained Lindsey Downing, Senior Vice President and Head of TransUnion Consumer Interactive. “In particular, providing customers with personalized solutions that enable them to protect their information can deepen their relationship with the financial institution — building trust and loyalty while creating opportunities for greater lifetime value.”

BaZingBiz SMB Solutions

StrategyCorps has designed its new solution, BaZingBiz, that offers a checking product solution specifically focused on the cyber and ID theft challenges facing an SMB today and in the foreseeable future that community FIs can provide to their SMB customers/members.

Given that many SMB accounts have been on “set and forget” with many community FIs over the years with little to no product changes or innovation, BaZingBiz also provides a way to upgrade SMB checking products to better compete with peers as well as megabanks and big regionals.

While BaZingBiz has a wide range of valuable features, its focus on digital security is one of its strongest features. Here are some of the highlights:

- Business ID Theft Aid Business Credit Monitoring, Score & Report monitors changes and new activity on your business credit report, view your business credit report, track your business credit score, and track trends on your dashboard.

- Business Dark Web & Domain Monitoring continuously surveys the dark web for changes or activity related to your business identity and data.

- Fully Managed Business ID Restoration in the event of identity theft or other related fraudulent crimes. Our full-time fraud experts can guide you through the complex process of restoring your business’s identity, financial security and legal integrity.

- Tailored Security Assessment will create an industry- specific Cyber Risk Profile to pinpoint and help you understand risks.

- $50,000 Cyber Liability Our Cyber Liability Program protects your business for specific costs of a data breach or cyber-attack. In the event of a breach, legal, forensics, and notification costs are covered up to $10,000, as well $5,000 for cyber deception.

- Coverage up to the $50,000 limit is also provided for privacy liability claims, defense, and regulatory fines and penalties.

- $10,000 Ransom Payment for your business to evaluate and respond to a ransom threat, including amounts paid by your company to resolve or terminate such a threat.

The simple fact is, business is changing faster than banking and this new environment will reward banks that develop checking products that deliver the kind services SMBs want and need today. And there’s plenty of real world data that shows community FIs that become better partners with their SMBs grow primacy, boost noninterest income, and can differentiate themselves from peers as well as megbanks.

Being a better partner is a way to ensure success for both SMBs and community banks.

James Mason is a SVP, Client Relationship Management where he leads initiatives to strengthen partnerships and drive value for financial institutions as well as empower financial institutions to better serve and support their communities. Feel free to contact him at james.mason@strategycorps.com for more information.