Community FI Leaders’ Survey Delivers Revealing Deposit Expectations for 2024

By Mike Branton

When it comes to finding out what community banks and credit unions are planning for the coming year related to deposit performance the best way is to ask them directly.

There’s no doubt that there’s plenty of data regularly published by third parties about community FIs and the broader banking industry regarding deposits and deposit related banking activity

But often the general observations from that third-party data doesn’t fully represent individual bankers’ nuanced views of their particular markets or their perspectives based on experiences, and also how these observations are acted on in terms of game-planning.

For example, S&P Global Market Intelligence reported in September that deposits were continuing to contract even after the turmoil from bank failures in the earlier part of the year. The biggest hits were taken by the largest US banks.

Some of this was due to the chilling effect of the instability at some niche regional banks. For example, it was widely reported in the mass media and banking industry media that the failure of Silicon Valley Bank (SVB) would cause a severe liquidity crisis across the entire industry for FIs of all sizes.

Yet bank executives at community FIs understood that SVB was a unique situation. And while negatively impacting their FIs, wouldn't create the widespread, severe disruption that occurred at SVB.

The Story Behind the Numbers

That’s why we decided to conduct a survey directly with hundreds of community banking and credit union leaders and see how they’re preparing for next year in terms of consumer and SMB deposit planning and actions given where they see market opportunities and challenges.

Our recent survey of these financial leaders generally shows that while many were bullish on deposit growth (about 55%) and growing debit interchange fees (about 40%), the amount of growth doesn’t indicate that this optimism matches the kind of growth necessary to offset the continued revenue headwinds they’re feeling.

The bankers’ chief concern was deposit attrition and increasing cost of funds as nearly two-thirds expected growth in deposits to be 5% or less, which won’t keep up with natural attrition rates. As far as deposit-related, non-interest income growth, nearly 60% of bankers see that coming from debit interchange fees at a time when consumers are at a historical high in terms of spending.

Data from other sources, for example, an October study by the Conference of State Bank Supervisors, aligns mostly with the top three external challenges facing community banks - net interest margins, cost of funds, and core deposit growth. However, there was not an alignment of optimism on the growth of deposits given these challenges.

An Interesting Take on Competitors

Another very interesting insight was that our bank executive respondents were concerned with a competitor that doesn’t usually come to mind when we think of competitive pressures for deposits (consumer and SMBs).

The top competitor they named was megabanks. This isn’t a surprise since they’ve been dominating deposit market share growth for the past decade or so. But surprisingly rising to the No. 3 spot were community banks, which have been taking the brunt of deposit market share loss from megabanks (and digital banks and bank-backed fintechs).

In regard to the digital and bank-backed fintechs, these continue to be seen by most bankers as less threatening competitors despite overwhelming evidence to the contrary on a national basis. This is similar to the anecdotal research we hear from execs at most traditional FIs - these types of banks aren’t gaining market share at their expense (namely consumer deposits versus SMB deposits).

Grow Deposits from Within or Without

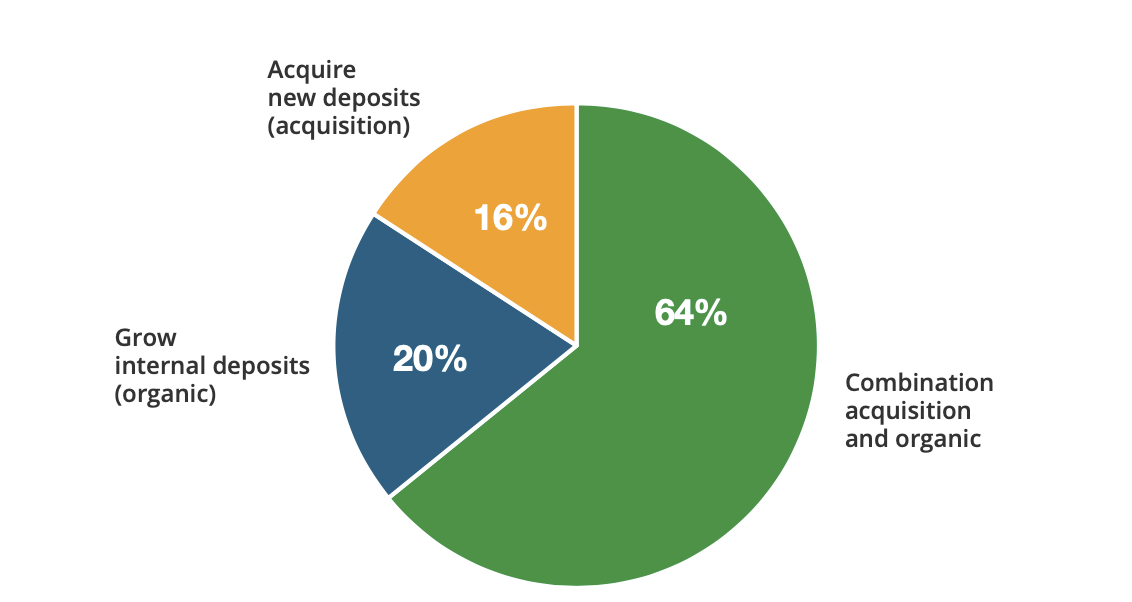

On the question of how will your FI grow deposits, we were pleased to see most respondents (64%) were game planning to both acquire net new deposits and grow existing deposits (organic). Acquisition of net new deposits at an acceptable cost of funds and ever-increasing competition is expensive, and only 16% of bankers were just focusing on this.

The key question on deposit growth is “how does an FI do it?”, whether it be acquisition or organic or both. Enhancing digital platforms in terms of customer interaction (both consumers and SMBs) was the top priority. (Our take here is that this is just table stakes to maintain market share rather than a differentiated way to grow it.)

The second top priority was rolling out new and improved products, which is encouraging and long overdue. And it is also the reason that mega-, digital- and fintechs have been winning the battle for deposits.

Having a great digital user experience is important but if your products are undifferentiated and lame, it won’t drive deposit growth.

As checking product innovators and strategists, we’re excited bankers are finally making products a top priority!

If you’re interested in the entire survey results report, download it here.

Mike Branton is a financial expert and partner at StrategyCorps. You can connect with him at mike.branton@strategycorps.com