Research Part 2: Reinventing a Community FI Strategy to Regain SMB Market Share

Editor’s Note:

This is the second in a monthly series exploring market research we commissioned with financial services firm Cornerstone Advisors to get a state of market view through the eyes of SMB leaders across the country.

Our main goal was to understand their challenges now and how community financial institutions could best compete for their business moving forward.

This subject has become even more timely as the consumer deposit and spending environment is changing for consumers, which has a direct effect on SMBs revenue and loans. Community banks and credit unions have been the traditional leaders working with SMBs. And that can remain the rule – if community FIs can deliver the kind of service and products SMBs are looking for.

This second section sets out the reasons why community FIs can’t afford to hunker down and wait until current conditions blow over.

“Banks will have to reinvent the business checking account.

And they’ll do it not just because there’s a fee-based revenue opportunity associated with doing it, but because a reinvented business checking account will become the mechanism by which banks engage SMBs, generate data about SMBs, and identify, sell and close lending opportunities with SMBs.

This report provides evidence for this shift in commercial banking strategy and recommendations to banks and larger credit unions on how to reinvent the business checking account to capitalize on the promised opportunities

In March 2023, Cornerstone Advisors surveyed 1,009 U.S.-based small business owners and senior executives about their companies’ financial relationships and preferences.

Roughly three in 10 respondents came from businesses with revenue between $100,000 and $1 million, 37% from firms with $1 million to $10 million in sales, and 34% from SMBs with $10 million to $100 million in sales.

A quarter of survey respondents are owners or partners of their firm, 25% are CEO or president of their company, and half are responsible for the management of their company's finances. The spread of respondents across SIC codes is representative of the allocation of small and medium-size businesses in the United States.

SMBs Banking Relationships

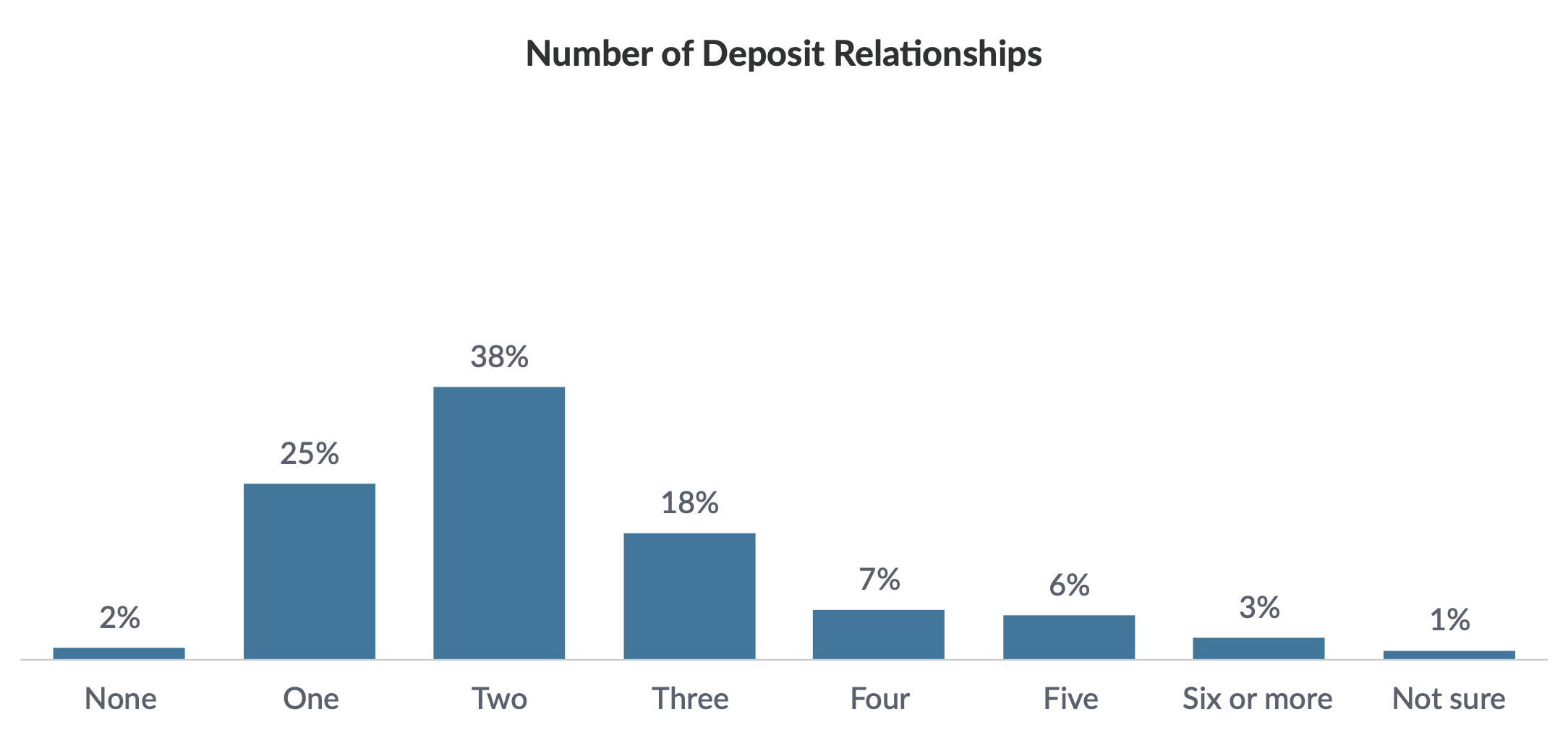

The Silicon Valley Bank crisis had a swift impact on SMBs’ financial lives. Within weeks of the crisis, more than seven in 10 SMBs reported having two or more deposit-related (i.e., checking, cash management or savings/CD/money market account) relationships.

Source: Cornerstone Advisors survey of 1,009 small to medium-size business owners and executives, March 2023

Based on a Q1 2020 survey of SMBs, we estimate less than half had multiple deposit relationships at that time. On the lending side, more than half of SMBs have two or more relationships.

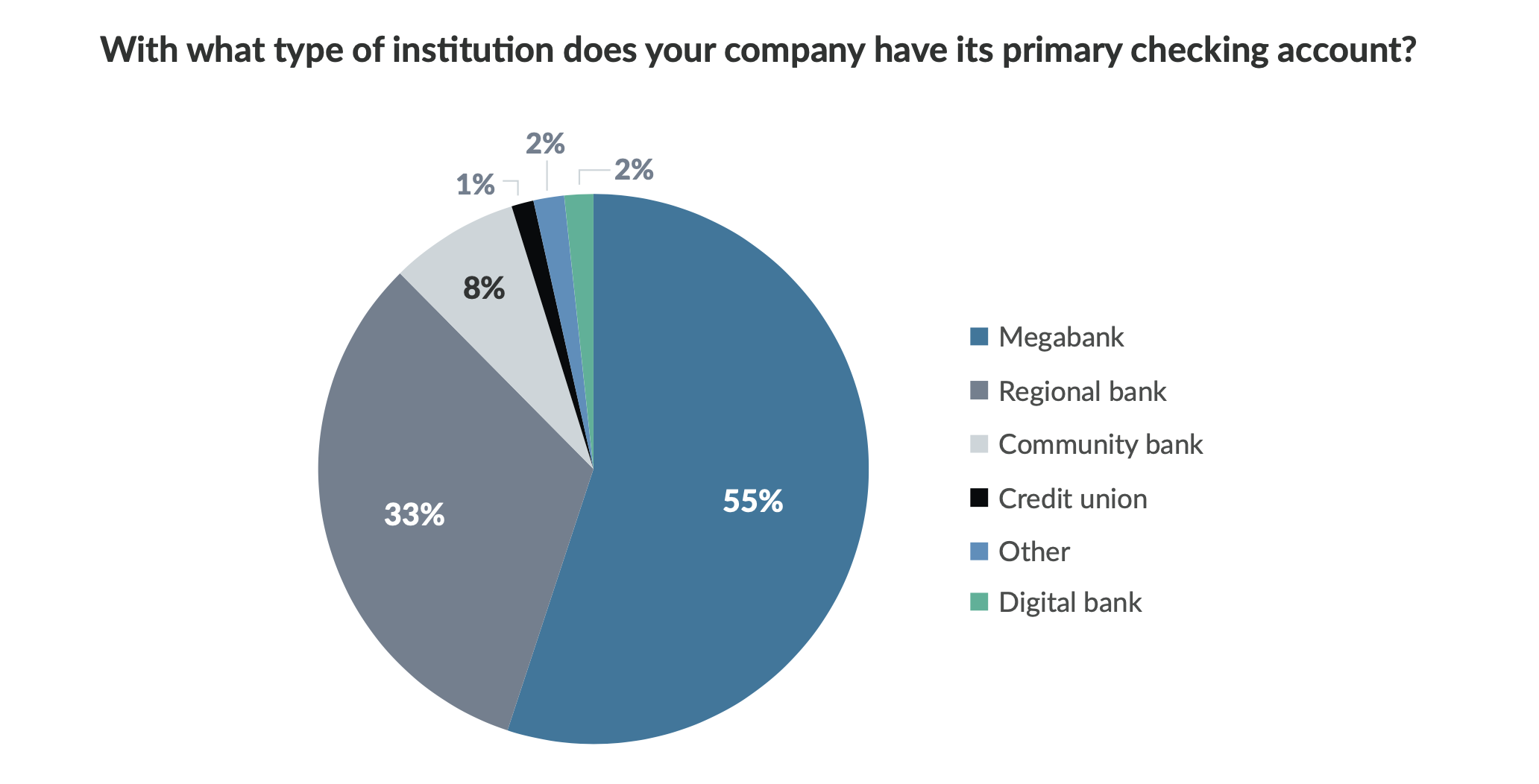

More than half of SMBs have their primary checking account with one of the four megabanks (Bank of America, Chase, Citi and Wells Fargo), and for about a third it’s with a large regional bank. Just 9% said their primary checking account is with a community bank or credit union.

Source: Cornerstone Advisors survey of 1,009 small to medium-size business owners and executives, March 2023

Even among SMBs with annual revenue less than $5 million, community banks and credit unions have less than 15% primary checking account market share.

SMBs’ Payments Relationships Overall, 65% of SMBs use the debit card associated with their primary checking account at least once a week, but behaviors differ greatly depending on who the primary provider is.

Among SMBs whose primary checking account is from a megabank or regional bank, roughly seven in 10 use the debit card from that account every week.

Just 27% of SMBs that bank with a community bank use the account’s debit card that frequently, however, and more than half never use the card.

Editor’s Note: On this last point, it’s interesting to note that often the megabanks and big regionals offer credit cards and debit cards at the time a new SMB account is opened, which isn’t the case with many community FIs. Such small efforts can create significant long-term opportunities over time.

The goal of this survey was to get a better understanding of the thinking behind how SMB leaders are banking today; what motivates their choices; and how to lure them away from their current primary banking relationships.

To learn more about the results of the survey, download the results, or contact dave.defazio@strategycorps.com.

Next month, we’ll explore the three SMB banking paradoxes that reveal real opportunities for community FIs to regain their relevance with SMBs and drive non-interest income as well as primacy within this important commercial accounts sector.