Research Part 1: Reinventing a Community FI Strategy to Regain SMB Market Share

Editor’s Note: This is the first in a monthly series exploring market research we commissioned with financial services firm Cornerstone Advisors to get a state of market view through the eyes of SMB leaders across the country.

Our main goal was to understand their challenges now and how community financial institutions could best compete for their business moving forward.

This subject has become even more timely as the number of SMB bankruptcies is starting to rise. Community banks and credit unions have been the traditional leaders working with SMBs. And that can remain the rule – if community FIs can deliver the kind of service and products SMBs are looking for.

This first section sets out the reasons why community FIs can’t afford to hunker down and wait until current conditions blow over.

“Had Cornerstone Advisors published a forecast regarding banking relationships among small and medium-size businesses (SMBs) before March 2023, we would have predicted that SMBs would, over the next few years, expand their deposit relationships across banks.

Why? Because we believe that like consumers—many of whom now use multiple checking accounts from different providers in search of specialized features and functionality—SMBs would increasingly seek out financial institutions with superior business checking account capabilities.

Alas, the Silicon Valley Bank meltdown beat us to the punch. The SVB crisis raised fears in the hearts and minds of SMBs that their banks would suffer similar fates, causing many to open new accounts with new banks and spread out their money in search of fully insured deposits.

We missed the boat on that one, but here’s a prediction that hasn’t already happened: The movement of funds and opening of new accounts isn’t over. In the next three to five years, many SMBs will continue to move their money and enter new relationships in search of:

1) business checking accounts that provide more value than is offered in the accounts they have today, and

2) accounts that offer a bundle of features and capabilities aligned with their unique needs.

The SVB debacle simply accelerated and exacerbated a trend that was already underway. It emphasized the new reality in small business banking: Banks can’t sit back and grow checking accounts and deposits through lending—they have to grow their lending business by first growing their deposit relationships.

Threats to Community Banks’ Business Relationships

The SVB debacle was a shock to the system, but there are more systemic trends—and threats—in play within the banking industry, including:

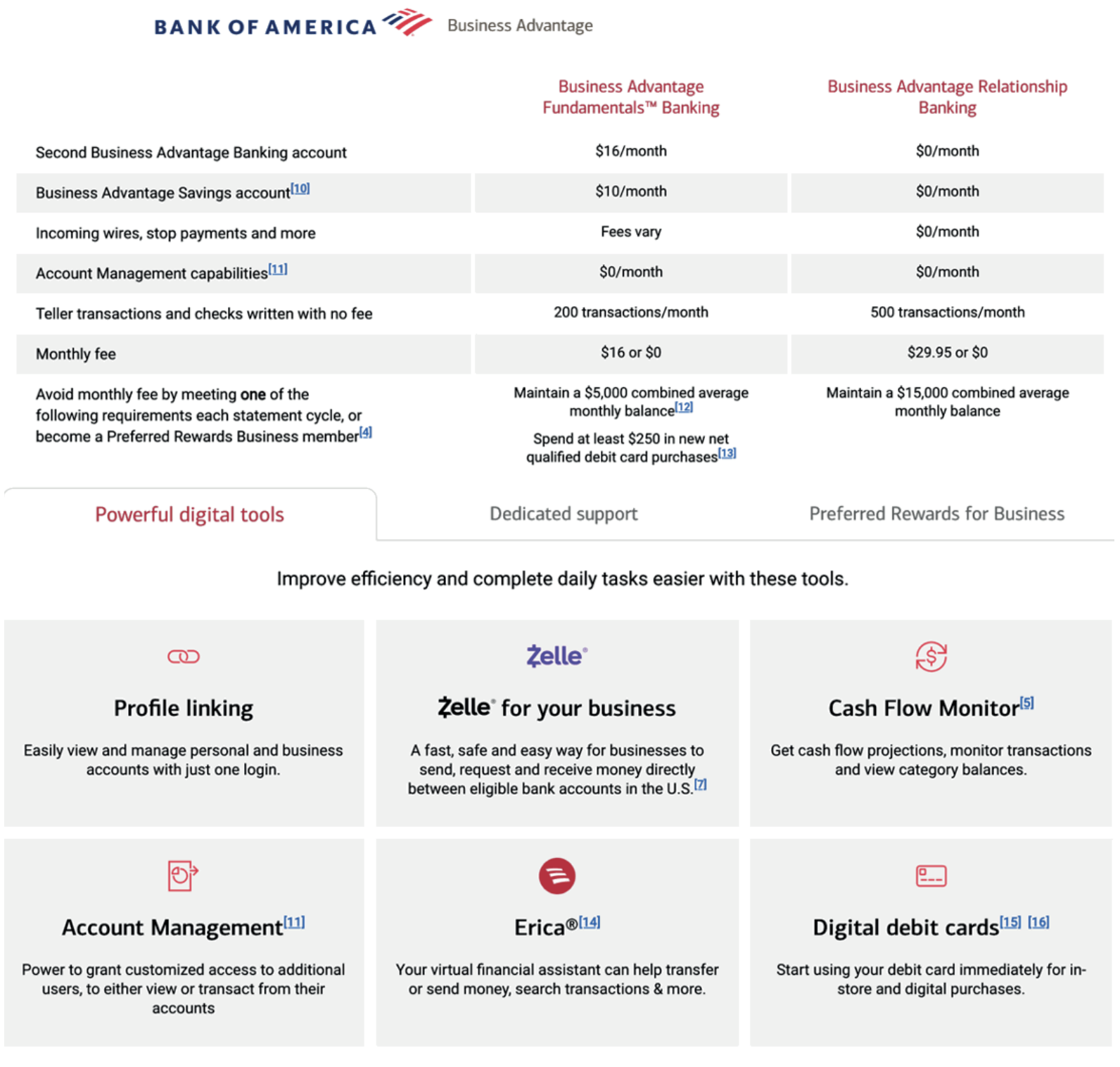

- Strong pricing and technology support from the big banks. Bank of America is a great example. The megabank offers SMBs two pricing tiers—a $16 per month option and a $30 per month option. Qualifying for a fee waiver with the first tier can be done by maintaining a $5,000 monthly balance or by spending at least $250 per month on the account’s debit card.

Source: Bank of America

The bank also offers SMBs the ability to use Zelle to send, request and receive money among eligible bank accounts in the United States (you’ll see later on why this is important). In addition, the bank offers value-added services like a cash flow monitor, cyber threat protection and fraud protection.

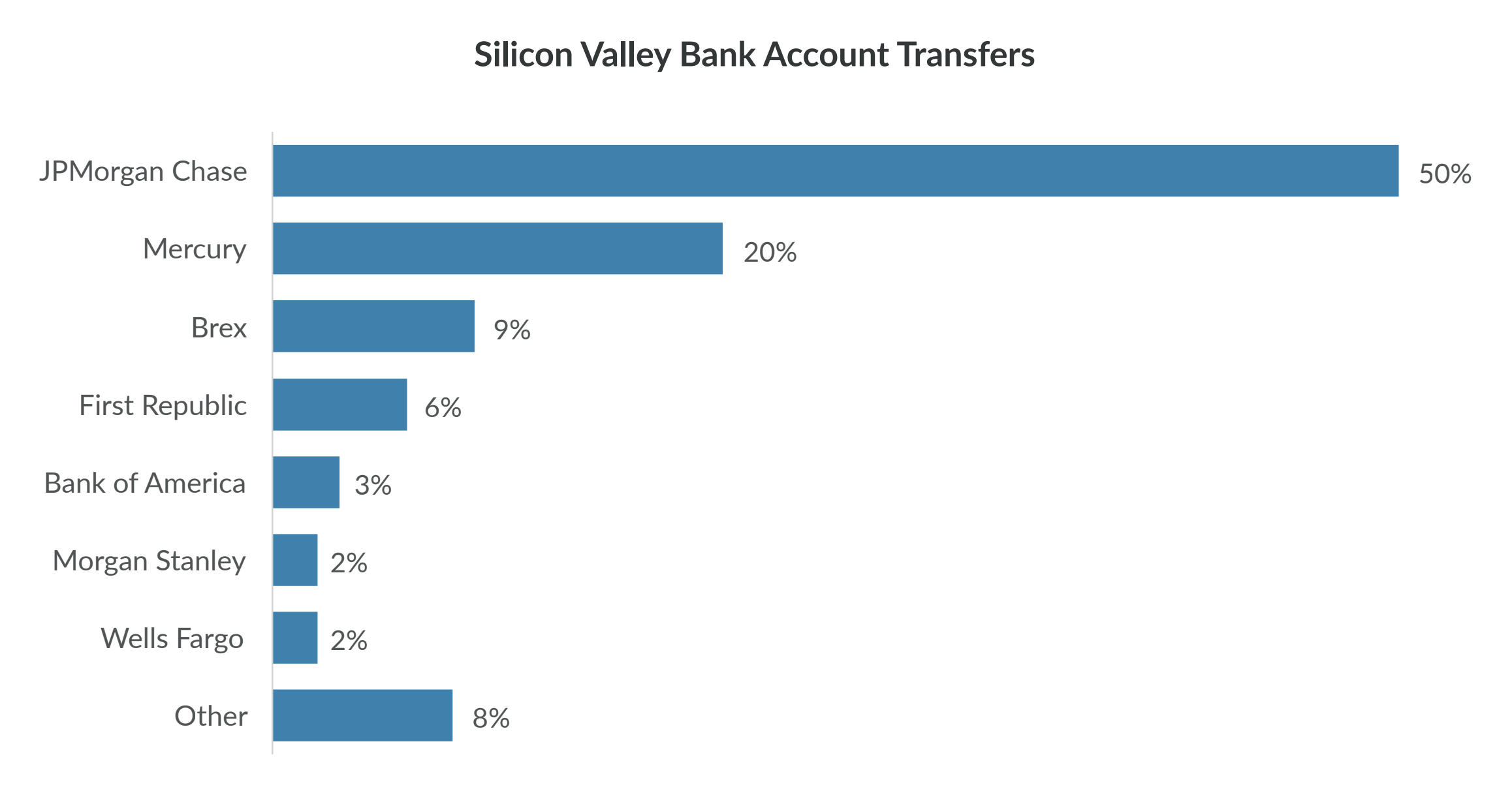

- Niche fintechs. The “niche”—or narrow consumer segment—strategy in fintech has taken some lumps recently, but, in the business banking space, a number of players are developing a strong offering and cherry picking valuable business customers from established financial institutions. According to Kruze Consulting, nearly three in 10 of their clients with accounts at SVB opened new accounts at fintechs and megabanks during the run on the bank.

Source: Kruze Consulting

- Vertical SaaS applications and platforms. Many SMBs use SaaS applications specific to their industry segment or platforms like Amazon, Shopify and Square. Half of SMBs using Square have opened a checking account with the platform, and among all SMBs, many expressed interest in opening checking accounts or getting loans from these platforms and vertical SaaS application providers.”

The goal of this survey was to get a better understanding of where SMB leaders were banking today, what were their motivations in their choice, and what would lure them away from their current primary banking relationship. The insights were helpful and surprising.

To learn more about the results of the survey, check out the full report, or contact dave.defazio@strategycorps.com.

Next month, we’ll discuss how these new threats have brought about a new business banking imperative and how community FIs willing to adapt can succeed.