The Great Deposit Race: Optimizing the “Less is More Strategy”

Choosing a proactive strategy to prune unproductive accounts may seem radical

By Gregg Early

It may seem counterintuitive to think that the best way to build primacy, grow deposits organically, and generate more non-interest income is to focus on determining which accounts aren’t financially productive and how to fix that relationship with your FI.

Community banks and credit unions have been doing this for more than two decades. And it works remarkably well, with far less risk than you may think, if done as part of a thoughtful, flat-fee checking product realignment.

Organic vs Acquisitive Growth Costs and Risks

Recently there has been a significant effort for financial institutions to boost deposit growth. But just acquiring new clients doesn’t necessarily solve the fundamental issue of boosting earnings long term.

Acquisitive growth is expensive. And it can be even more expensive if the customers that you bring in are simply parking cash. Since Covid, CD balances are way up but that is because of banks “buying money” by raising CD rates to compete for dollars. Yet these will be increasingly expensive to service as rates begin to fall, which is already happening. So the long-term price of those new accounts is basically narrowing NIM.

The goal should always be to build primary relationships rather than just grow the number of accounts. That’s why focusing on primacy and organic growth is the smart long-term choice.

Flat Fee Checking Risk and Rewards

And one proven way to do this is using flat fee checking accounts that offer a subscription model with value-added benefits. But changing checking products to a simplified system with flat fee products and possibly a free product and a high-interest one, may mean losing some accounts.

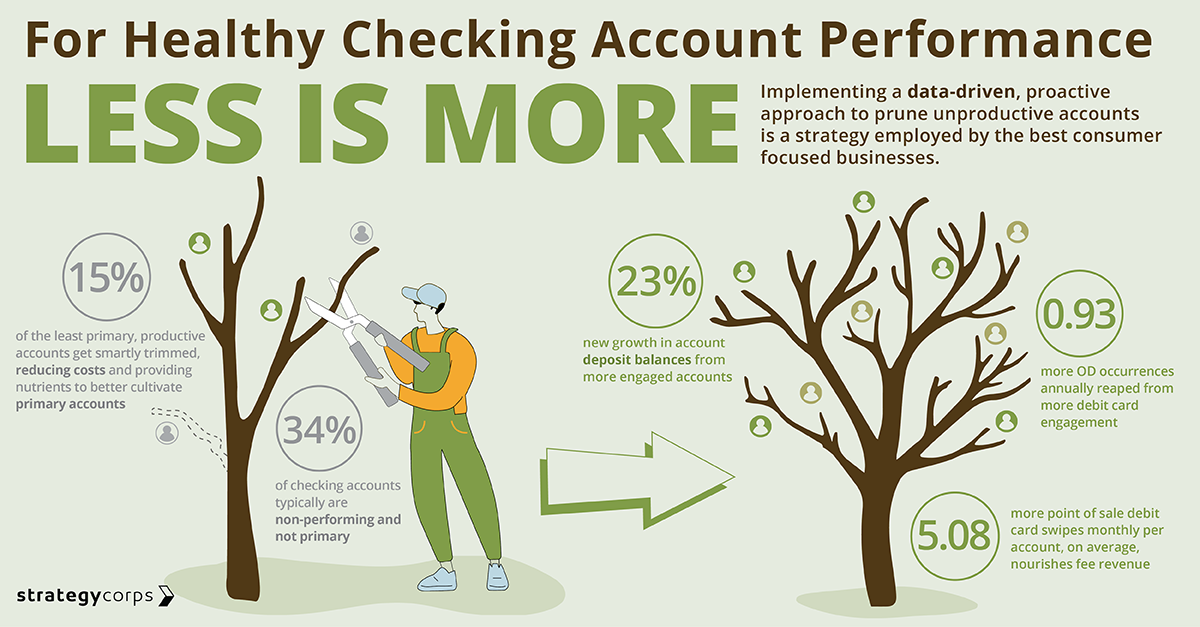

For example, on average 34% of checking accounts at the typical community FI are non-performing and that has a significant effect on overall performance, especially when new deposits are hard to find or are expensive to attract.

So, the cost of maintaining a checking account for the average FI is $350. If you multiply that by 100 accounts that’s a lot of money, time, and energy poured into non-productive accounts.

If you move a nonproductive, disengaged, small/low account into a flat fee account here is what happens (on average but a lot of time at a minimum): 15% of accounts close, and if done well, this loss actually helps the accounts that choose to stay.

And here’s the good part. What our numbers, compiled over the past two decades, show that of the 85% left:

- Balances go up 23%

- OD/NSF occurrences increase by 0.93 per year

- Average monthly Point of Sale debit card use goes up by 5.08 per month

Building More Primary Relationships

Another important fact to remember is, most small/low accounts are one loan payment away from not being a loan customer. And most of these accounts have no loan, so, there is only one way to go: up!

Flat fee checking creates a deeper relationship with each customer and they start seeing their community FI as their primary institution because of the value derived from their most fundamental accounts. This creates a competitive edge that differentiates your community FI from local competitors as well as regional banks and megabanks.

All Accounts Should Be Mutually Beneficial

It’s not unrealistic for a community FI to compel a mutually beneficial decision. If an account holder doesn’t have a relationship with your FI that’s valuable to both sides - despite your FI’s cross-selling efforts - and the account holder is maintaining a primary relationship where their banking needs are being met, then it makes sense to offer an upgrade to a better account for them (more value) that’s more financially productive for your FI rather than just increasing fees.

Injecting value into the checking product relationship rather than a price increase for the same value differentiates the value proposition of your product, grows consumer-friendly non-interest income, and increases the likelihood of your FI becoming their primary FI.

Less of a Risk Than It Seems

Choosing a proactive strategy to prune unproductive accounts may seem radical, but it’s really no different than the strategy employed by many focused businesses. And it’s standard operating procedure for maintaining healthy email prospect lists.

Will your FI lose some account holders by forcing this decision? Yes, but these unprofitable relationships that may be an ongoing cost will be off your books.

Will some unproductive account holders stay at your FI? Yes, but most who were upgraded will help ease the sting of the continuing unprofitable relationships.

Will the total number of accounts decrease? Yes initially, but the financial performance of the remaining ones will be much better than the ones remaining that are a drag on your earnings.

Will it also mean that you don’t have to risk narrowing NIM attracting new customers solely based on interest rates on accounts or loans in the current dynamic rate environment? Yes, optimizing current customers is a financial and risk management hedge on the costly and risky acquisition growth strategy.

Gregg Early is a financial writer and editor who's worked as a journalist for American Banker, Bond Buyer, and others covering the SEC, MSRB, Supreme Court, and various Congressional finance committees. His expertise is fintech, emerging technologies, biotech, ESG, green tech, cryptocurrencies and derivatives. His work has been featured on CNBC, CNN, and Bloomberg, as well as in The New York Times, Washington Post, Wall Street Journal, and Businessweek. Contact him at gregg.early@strategycorps.com.