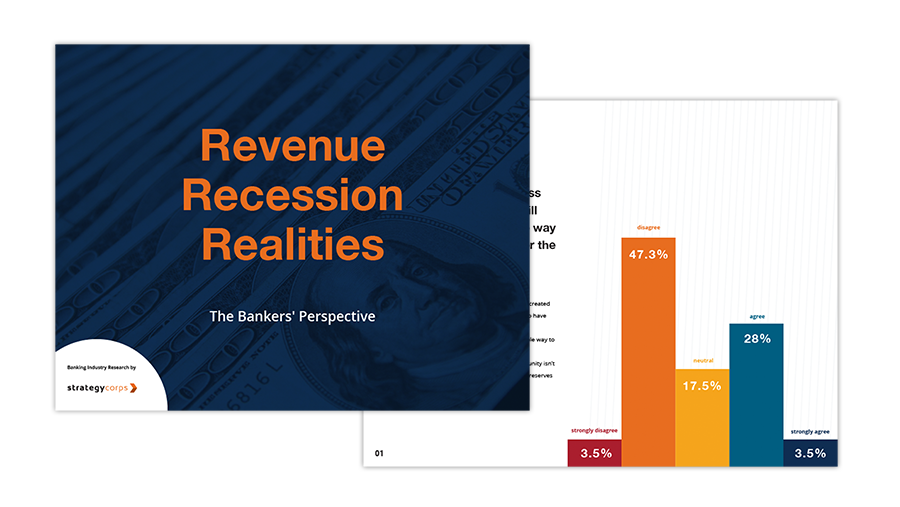

We surveyed hundreds of bankers to get their perception of the reality and severity of this “revenue recession” over the next 12 months, including insights on:

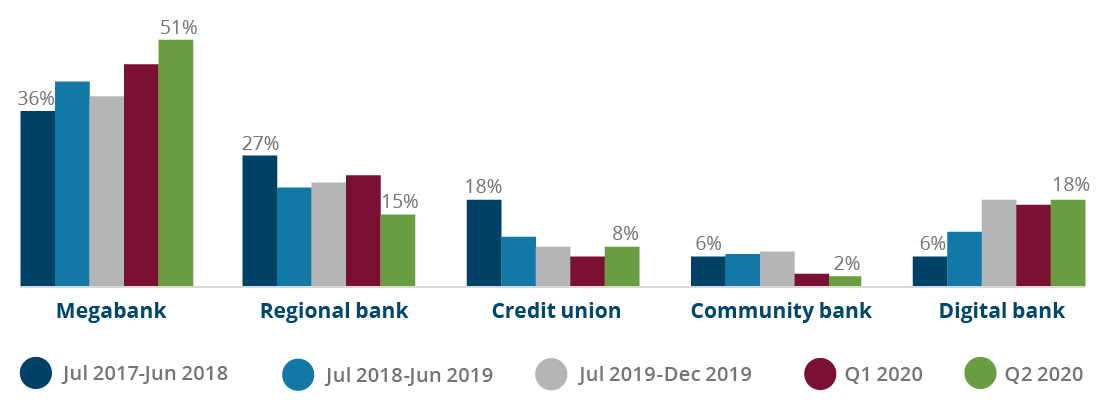

The competing financial institutions on the corner, down the street, or on the other side of town aren’t the biggest threat to community financial institutions growing market share as well as customer/member primacy. To succeed in today’s market, you have to compete with the growing digital footprint and products of megabanks, digital banks, and Big Tech.

Products are more important than ever.

Megabanks and digital banks are offering better products that consumers are discovering and opening online, which is growing their consumer market share at the expense of the regional and community banks and credit unions. This begins the displacement of regional and community FIs as the primary FI for consumers.

Our new research by Cornerstone Advisors provides an illuminating, deep-dive into changing consumer behaviors and attitudes that threaten the traditional roles that community-based FIs have played.

Here are just a few insights:

Incredible takeaways into how consumers view banking with Google, other Big Techs, and digital banks versus traditional FIs

An understanding of the financial and primacy impact to FIs from consumers having an increasingly active secondary checking account

Which specific product features and benefits consumers want from Big Techs and traditional and digital FIs

Here are just a few insights:

Incredible takeaways into how consumers view banking with Google, other Big Techs, and digital banks versus traditional FIs

An understanding of the financial and primacy impact to FIs from consumers having an increasingly active secondary checking account

Which specific product features and benefits consumers want from Big Techs and traditional and digital FIs

Our Additional Market Research

Accessorizing the Checking Account

Consumers want rewards. However, only 10% of community bank customers and 16% of credit union members earn checking account rewards. That’s in contrast to 26% of megabank customers and 20% of regional bank customers. Want to learn what you can do to win over Millennials? Download Accessorizing the Checking Account for free today.

Reinventing Checking Accounts

Your financial institution’s checking account strategies must evolve to survive in the new subscription economy. For more background on why consumers are willing to pay for value when it comes to banking products, download Reinventing Checking Accounts, a free white paper loaded with additional insights.

Our Additional Market Research

Accessorizing the Checking Account

Consumers want rewards. However, only 10% of community bank customers and 16% of credit union members earn checking account rewards. That’s in contrast to 26% of megabank customers and 20% of regional bank customers. Want to learn what you can do to win over Millennials? Download Accessorizing the Checking Account for free today.

Reinventing Checking Accounts

Your financial institution’s checking account strategies must evolve to survive in the new subscription economy. For more background on why consumers are willing to pay for value when it comes to banking products, download Reinventing Checking Accounts, a free white paper loaded with additional insights.