Provide Endless Value With Checking Accounts

Consumers want value, plain and simple. Mega banks, fintechs, and neobanks are providing value through powerful digital experiences that many community-based banks and credit unions consider difficult to implement. So what can these financial institutions do to compete?

The answer is to go beyond simply a user experience mindset and rethink the very products being offered. Simply put, it’s time to rethink core relationship products like checking. Accessorizing the checking account with value-added services that consumers want or perhaps are already paying for elsewhere, makes perfect sense.

One challenge is deciding what added services will attract consumers. Fortunately, there’s research available to you from the banking and technology experts at Cornerstone Advisors.

The Value-Added Services Consumers Seek

Here are some value-added services the Cornerstone Research has identified as high-value:

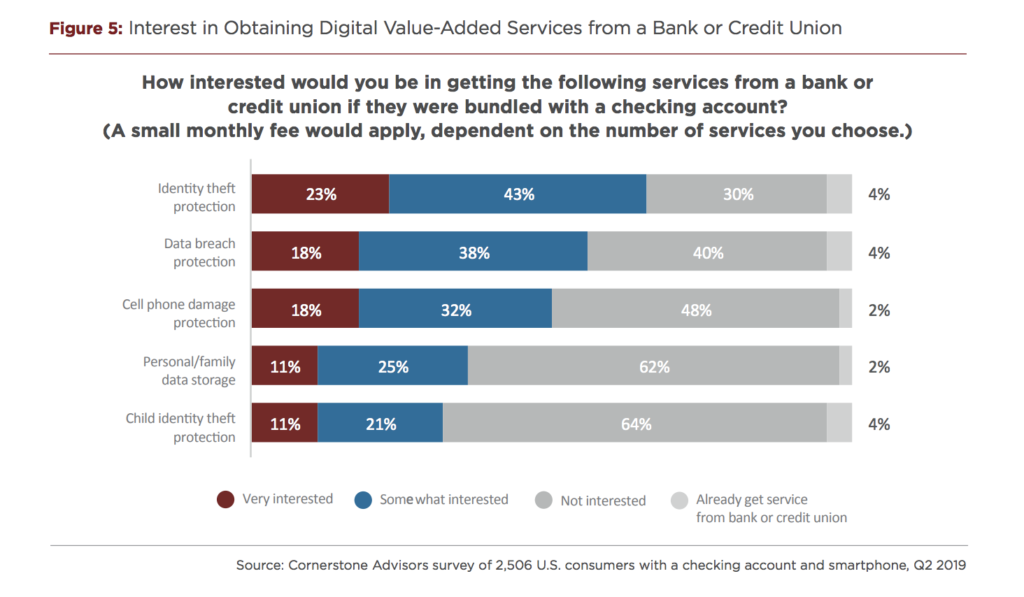

Cell Phone and ID Theft Protection

We now live glued to our mobile devices. As a result, it’s become painfully clear that a broken phone or personal data breach can lead to seemingly devastating consequences. Half of consumers already have access to cell phone damage protection and a whopping 32% are paying for it out-of-pocket.

Similarly, half of these consumers also have identity theft protection, with about one in five paying for it themselves. The repercussions of personal data breaches and identity theft are numerous and it is time-consuming to resolve. Having a shield around one’s personal information is paramount.

Digital services, such as cell phone and ID theft protection, present a prime opportunity for adding value to consumer relationships and checking products.

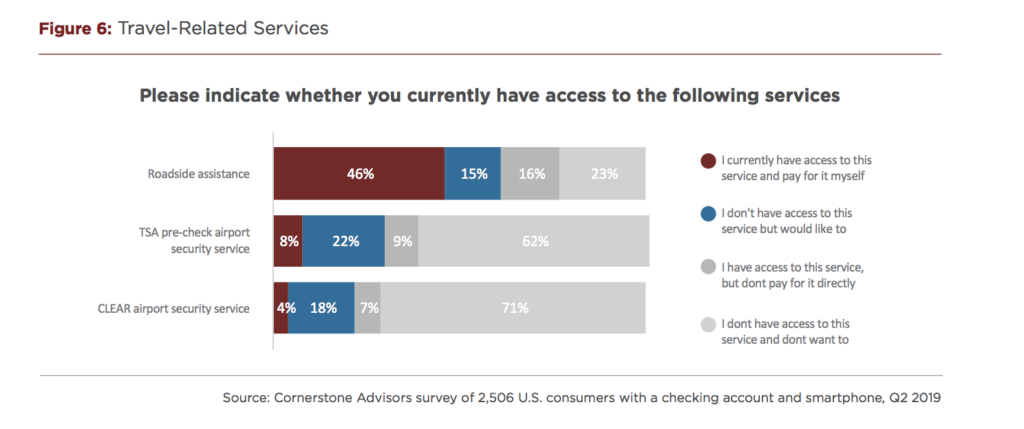

Travel-Related Services – Roadside Assistance

Having access to a vehicle on a daily basis is a necessity for a remarkable number of Americans. Unfortunately, car problems can inevitably rear their ugly heads, often at the most inopportune moments.

More than 60% of consumers pay for roadside assistance services such as AAA, AARP, and Allstate Motor Club, simply because they have to. This is particularly true for younger millennials who must use their vehicles to commute to work, to travel, and to facilitate the busy social life of a young adult.

Paying less for roadside assistance through a checking account instead of paying for it outright is a no brainer for drivers of all ages.

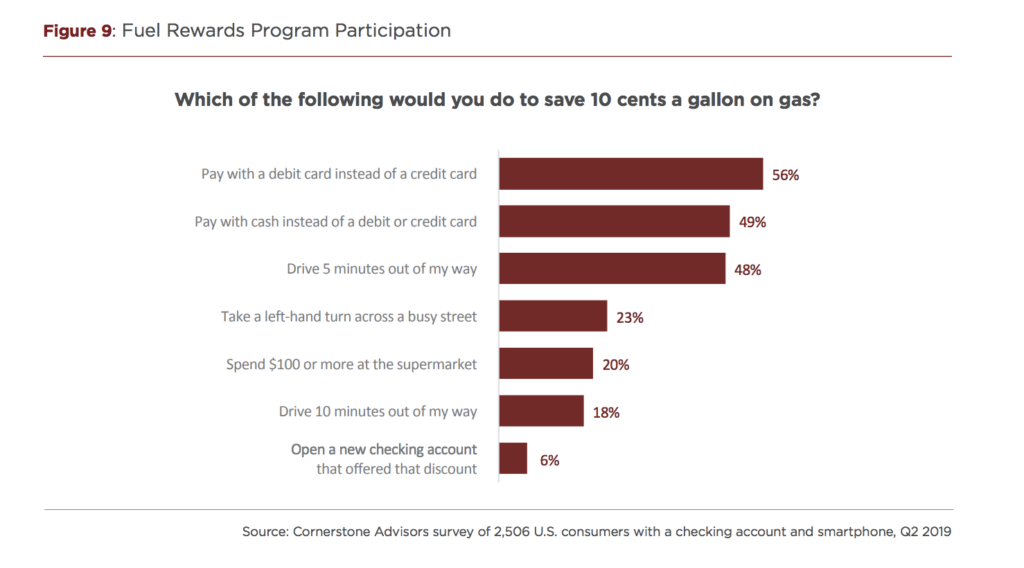

Fuel Rewards

In conjunction with keeping a car running, there’s no way to avoid the need for gas. Because of this, many grocery stores and supermarket chains have implemented fuel rewards programs to help customers save on gas prices. More than 50% of consumers already belong to one or more of these programs.

However, four in 10 Millennials still pay for their gas with cash rather than debit cards in order to save money. By including a fuel rewards program with checking accounts, not only can financial institutions add more value to their products, but it can also incentivize consumers to use their debit cards more.

In fact, over 50% of consumers reported that they would pay with a debit card over a credit card to earn fuel rewards. Believe it or not, nearly 50% even said they would drive five minutes out of their way to a gas station with rewards, with another 10% willing to drive 10 minutes out of their way.

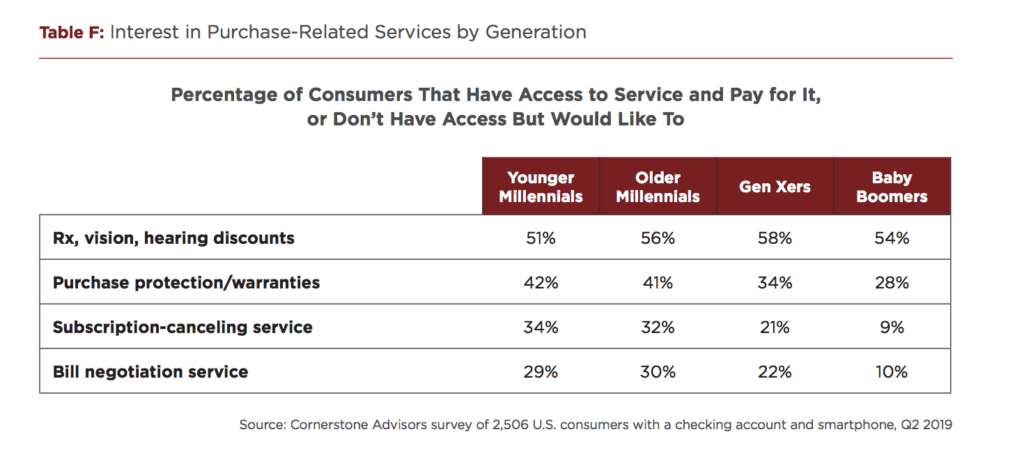

Purchase-Related Services

Paying for anything healthcare-related is a nerve-wracking experience. Not surprisingly, 37% of consumers say they currently pay to receive discounts on services like vision and hearing, with another 18% interested in gaining access to these types of discounts.

In particular, Millennials show substantial interest in obtaining these services, many of whom would like to receive them specifically from their bank or credit union.

Insurance-Related Services

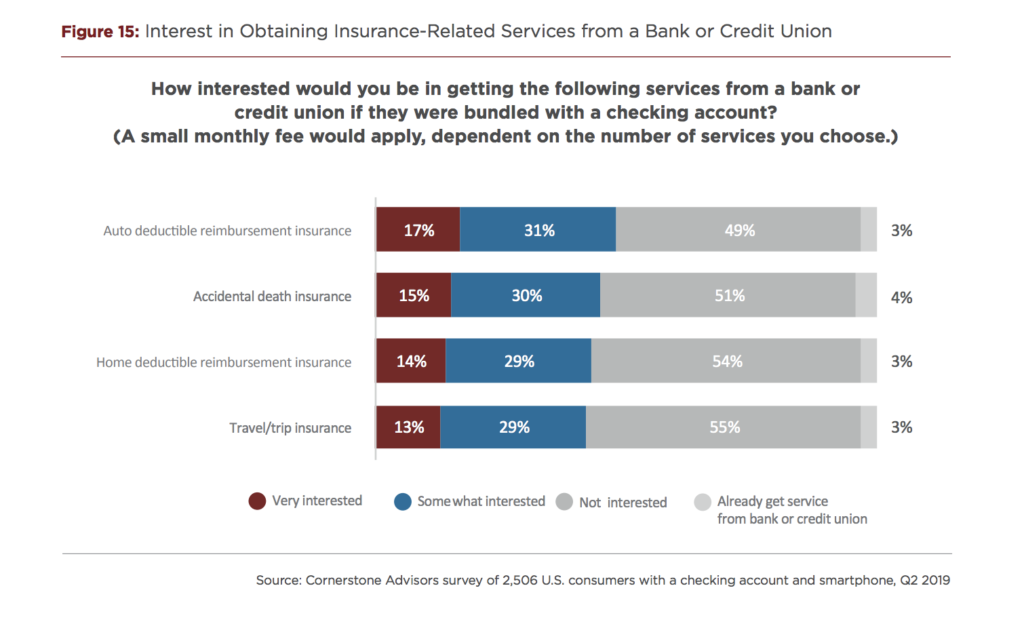

People should always be prepared for the worst, even though we rarely are. A maximum of 20% of consumers currently have access to (and pay for) accidental death insurance, travel insurance, and auto and home deductible reimbursement insurance. But when asked if these are services they would like to have, nearly one in five reported interest in at least one of these services, with four in 10 expressing some level of interest in obtaining all four of these services from a financial institution.

Accessorizing Checking Accounts

All of these value-added services have a place in the lifestyles of consumers, and according to this research, it’s clear they want them. It’s time for banks and credit unions to accessorize their checking account offerings with these valuable additions. To delve deeper into this research and learn how to best optimize the value of checking accounts, download the free white paper from Cornerstone Advisors.