CorpsPartners

StrategyCorps and Members Development Company are joining forces.

Saving Money + Protection = Great Checking Experience

Our linked solutions give your credit union the tools to exceed your members’ banking needs and become their primary financial institution while helping you meet your financial goals.

- CheckingScore: our analytical tool with more than 600 million data points from tracking over seven million checking accounts

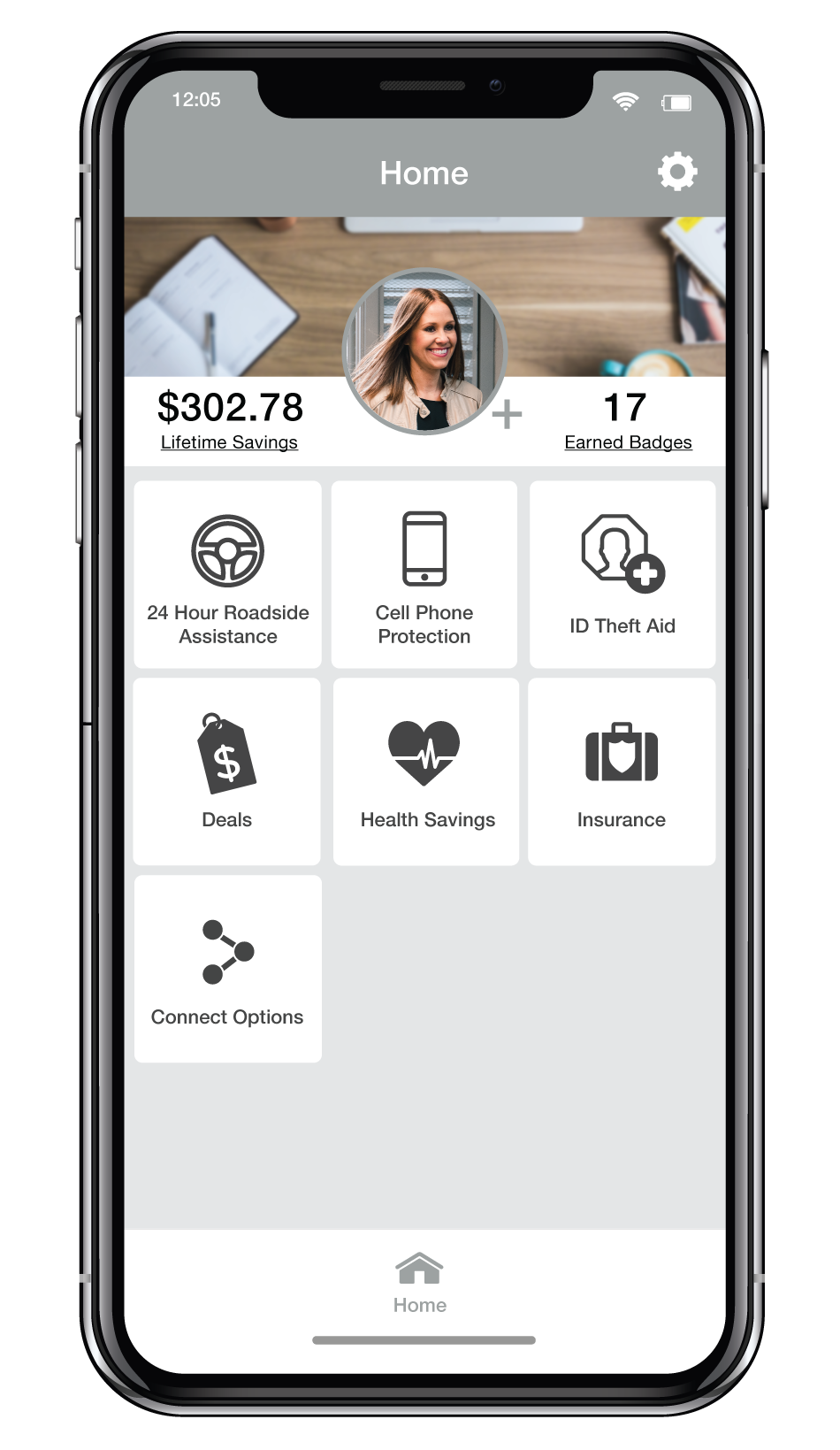

- BaZing: our industry-leading customizable, white-label mobile rewards app

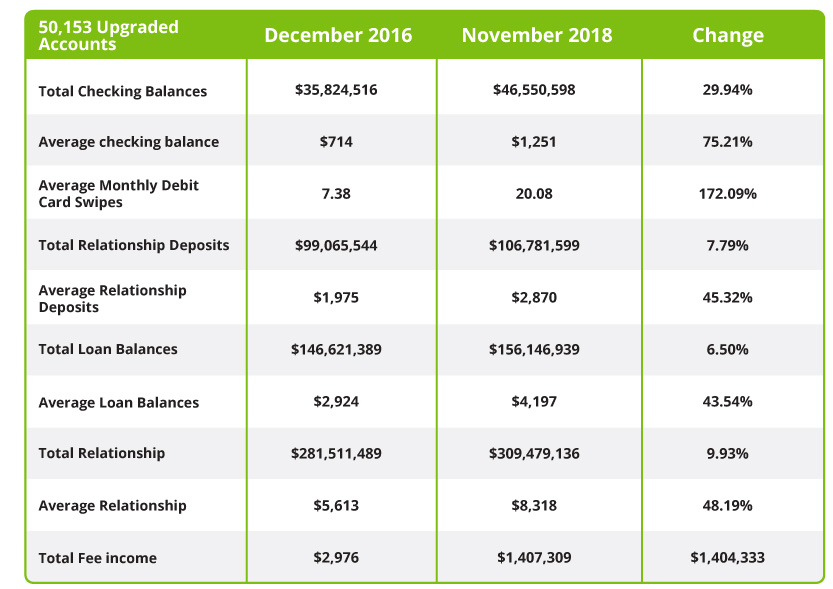

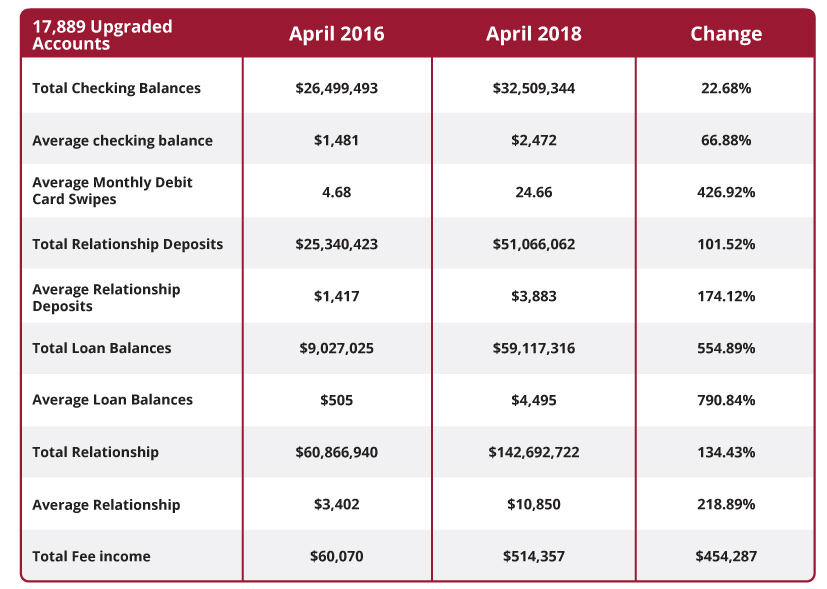

StrategyCorps can provide your Credit Union with Results

*Typical results

StrategyCorps Case Studies

Georgia’s Own is a full-service, not-for-profit financial institution owned by members, rather than controlled by stockholders. You’ll find all the products and services you’d expect from a financial institution, but with better rates and fewer, lower fees. They believe when they invest in their members, it strengthens communities, too. That’s banking on purpose.

Resource One Credit Union helps hard-working Texans achieve their financial goals. It's a credit union owned by its members and works to give them control of their future.

Since 1936, their members have trusted them to provide honest advice and the products they need. They share the profits with their members in the form of better rates and lower fees. Their membership continues to grow from the two largest counties in Texas: Dallas and Northwest Harris.

StrategyCorps helps credit unions grow retail checking relationships and financial productivity. Using its proprietary analytical tool, CheckingScore, and customizable mobile rewards app, BaZing, checking products are powered with modern, in-demand consumer benefits like cell phone insurance, local merchant discounts and roadside assistance that enhances member connection and provides competitive differentiation. Nearly 350 credit unions and banks employ our analytical and mobile solutions to generate industry-leading levels of performance and engagement for retail checking products.

MEMBERS Development Company is an interactive and future-focused network leading credit unions through collaborative innovation, development, thought leadership, and research. We create value by leveraging the combined strengths of our owners and dynamic partners to develop or identify innovative products and services that fulfill the needs and exceed the expectations of our credit unions and their members.

Resources

Accessorizing The Checking Account

Building on our earlier research, Reinventing Checking Accounts (also by Cornerstone Advisors), this white paper focuses on consumers and their specific preferences about financial institutions as well as what specific rewards consumers want from their checking relationship.

Reinventing Checking Accounts

For more background on why consumers are willing to pay for value when it comes to banking products, download the first free white paper in this series, Reinventing Checking Accounts, by Ron Shevlin, Director of Research at Cornerstone Advisors that is loaded with more insights.