Posts Tagged ‘Business Strategy’

Serve Where Customers Expect You to Be

When my 15-year-old daughter needs money to chip in for a car-owning friend’s next fuel fill-up or dinner out with her boyfriend, she doesn’t ask if I can swing by the ATM for her. She doesn’t ask to go to the bank with me, nor does she take checks. Heck, I don’t even think she’d…

Read MoreMoney in Excel

Microsoft and data aggregator, Plaid, announced a partnership to offer a new service called Money in Excel. This Microsoft Excel addition will allow users to connect their financial accounts to analyze monthly spending and activity. See what our very own Bryan Clagett, Director of Strategic Initiatives, has to say about this announcement at Forbes.com.

Read MoreInterview with Jim Marous

How has COVID-19 become a wake-up call for financial services? The COVID-19 crisis has been almost an instantaneous reveal of those institutions that had embraced digital transformation and those that only were presenting a pretty façade. If your firm required the consumer to visit your branch office at any time during a ‘digital’ new account…

Read MoreCash vs. Credit Card Spending Statistics: Before The Crisis

The COVID-19 crisis will likely ever alter the payment landscape. While it is premature to report usage stats, here’s a look at American Cash vs. Plastic usage as of December 2019, as reported by the Boston Federal Reserve.

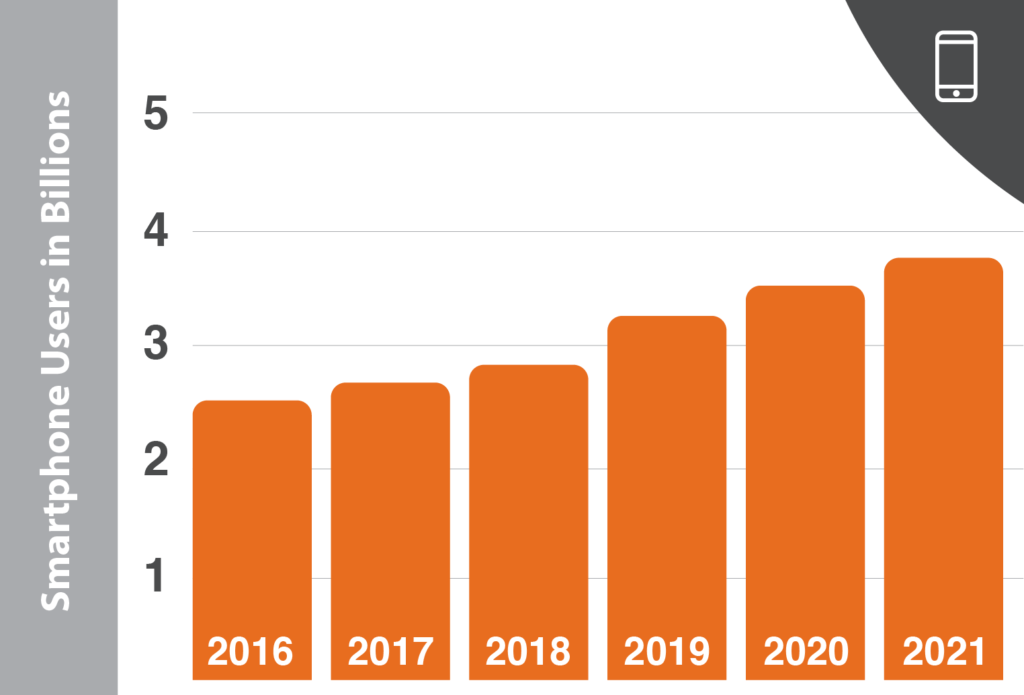

Read MoreSmartphone Ownership Surpasses Three Billion

The number of smartphone users worldwide surpassed three billion in February and is forecast to further grow by several hundred million in the next few years. While there has been some stagnation in smartphone purchases, the smartphone market still has high growth potential as the smartphone penetration rate is still lower than 70% in most…

Read MoreInterview with Bo McDonald

Clearly, no brand should exploit the Coronavirus pandemic, but what can banks and credit unions now do to demonstrate authenticity? I love stats, so let me start with that. According to a recent consumer study from Vision Critical, 91% of consumers value honesty in the brands they do business with, and 63% choose brands who…

Read MoreIn Time of Crisis, Leaders Must Communicate Carefully and Thoughtfully

Most of us likely never anticipated being in the throes of a pandemic, but here we are. The potential loss of life and economic impact is unknown, and that has led to fear. This is completely understandable. These are challenging times complicated by the dynamics of social media and political in-fighting. Your financial institution is…

Read MoreThe Economic Realities of Retail Checking in Today’s Marketplace

Ask 100 bankers, “Is retail checking profitable?” and you’ll likely get nearly 100 answers. StrategyCorps tracks over six million retail checking accounts with over 600 million data points – primarily from customers at community and small regional financial institutions – to get our answer to this question. Our analysis is based on householded revenue that…

Read More