Posts Tagged ‘Customer Relationship’

Monetize This!

Since the founding of the first U.S. bank, customers have expected to do their banking in the most modern way possible. By Ryan Harbry Imagine the following conversation: Customer service representative: “So, is this the right account for you?” New customer: “Yes, sounds great.” Customer service representative: “Excellent. In which case, I suggest signing up…

Read MorePrimary Relationships or Bust

By Ryan Harbry Customer loyalty is essential in every industry under the sun. In banking, it matters even more than most industries because not only do unloyal customers represent a missed opportunity for revenue; they have the potential to cost more than they are bringing in — creating a drag on earnings. And, if we’re…

Read MoreWhat’s in a Name?

By James Mason My friend and her six-year-old daughter were listening to music. Her daughter said that she’s never heard the song playing and that it was “weird,” so my friend said, “This was a popular song when I was a teenager in the ’90s.” Her daughter replied and said, “Oh. You mean in the…

Read MoreA Discussion on the Evolution of Fintech

Bryan Clagett, Director of Strategic Initiatives at StrategyCorps, has been featured on The Financial Experience Podcast! Each episode explores innovations and innovators across the financial and fintech industries.Hear our very own, Bryan Clagett, and former banker and current agency owner, Hunter Young, discuss the evolution of fintech on Episode 07: Where Will Data, Digital And Fintech…

Read MoreInterview with Bo McDonald

Clearly, no brand should exploit the Coronavirus pandemic, but what can banks and credit unions now do to demonstrate authenticity? I love stats, so let me start with that. According to a recent consumer study from Vision Critical, 91% of consumers value honesty in the brands they do business with, and 63% choose brands who…

Read MoreRetail Checking Realities

Forty percent of retail checking relationships are unprofitable, so crafting retail checking accounts that deepen customer relationships, drive deposit growth, and enhance the bottom line is a challenge faced by most financial institutions. How can bank leaders tackle this issue?

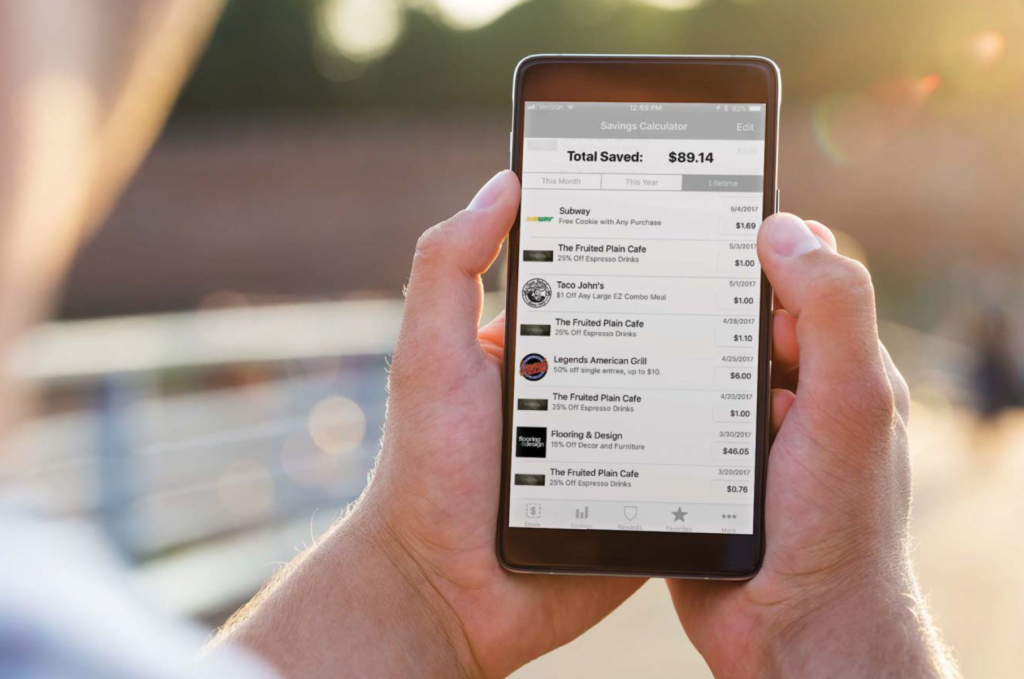

Read MoreEdging Out the Competition

Learn how American State Bank of Iowa’s mobile coupon app is a win for customers, local businesses and the bank itself. See the latest Main Street Focus article of IB Magazine.

Read MoreThe Profitability of the Average Checking Account

Maintaining a customer’s checking account costs your financial institution money. The American Bankers Association estimates the annual cost to a bank to maintain a checking account is between $250 and $400 per year. For community financial institutions with less than $5 billion in assets, the average according to other researchers is closer to $250 to $300.

Read More