Posts Tagged ‘Mobile Banking’

Three reasons megabanks are getting more checking account growth than community financial institutions

Consumer surveys often find that small and mid-size banks and credit unions enjoy higher levels of trust and Net Promoter Scores than do the megabanks (i.e., Bank of America, Citibank, JPMorgan Chase, Wells Fargo)—yet Millennials are taking their business to megabanks and large regionals. Why might you ask? Well, there are three reasons: Millennials love…

Read MoreServe Where Customers Expect You to Be

When my 15-year-old daughter needs money to chip in for a car-owning friend’s next fuel fill-up or dinner out with her boyfriend, she doesn’t ask if I can swing by the ATM for her. She doesn’t ask to go to the bank with me, nor does she take checks. Heck, I don’t even think she’d…

Read MoreRon Shevlin Discusses The Possibility of Google Entering the Banking Market.

Learn what Google’s upcoming plans could mean for banks and credit unions in Ron Shevlin’s recent article, Google: The Next Big Fintech Vendor. A consumer survey conducted by CornerstoneAdvisors and StrategyCorps shows unique insights on how Millennials would react if Google offered their own debit card. Ron also explains the obstacles that Google may face by attempting to join the…

Read MoreStrategyCorps Providing Free Health-Related Benefits to All Financial Institutions to Offer to Consumers as Response to Crisis

“In This Together” campaign lets banks and credit unions provide savings on prescriptions and eye and hearing care. BRENTWOOD, Tennessee, April 16, 2020 – StrategyCorps, the industry leader in providing value-added retail checking strategies and products, is helping financial institutions nationwide support their customers or members beyond just basic banking needs. With its “In This…

Read MoreStop Trying to Talk Your Customers Into Liking Your Checking Accounts

Recently I was reading an article from Chris Nichols, Chief Strategy Officer of Winter Haven, Florida-based CenterState Bank, entitled Public Perception of the Cost of Checking. Nichols shares how CenterState interviewed 200 randomly selected potential customers about what they thought about the bank’s pricing and value of its checking accounts. The pricing ranges from a fee of $5.95…

Read MoreWill Consumers Buy Mobile Banking Subscriptions?

The number of people using subscription services like Amazon Prime, Netflix, Spotify, Birchbox, Dollar Shave Club continues to soar. Can financial institutions take advantage of this new business model?

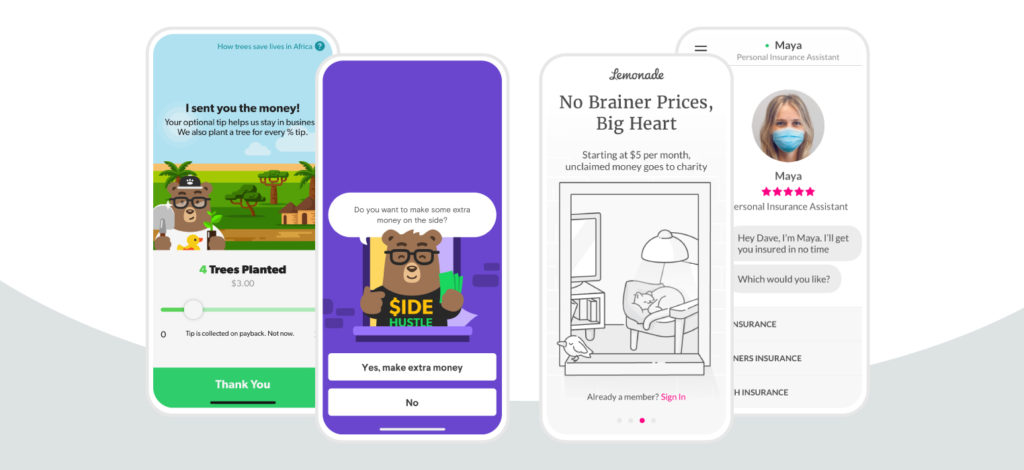

Read MoreMobile Banking: From Transaction to Experience

There’s been a significant shift in the retail landscape and the way people prefer to purchase. Today’s consumers expect more than just the ability to buy a product or, in the case of credit unions, conduct basic transactions. Instead, they expect a full-fledged experience.

Read MoreWhat’s Next for Mobile Banking?

Big banks are moving up the ranking and overtaking smaller banks in terms of satisfaction. They simply have what the mobile services customers want, when they want it. And they effectively communicate what they have. What good is having services if your customers don’t know about it? It’s like having a giant diamond but never being able to wear it. It’s [past] time to take the plunge and go beyond the basics.

Read More