Uncategorized

Redefining Primary Relationships

By Mike Branton and Dave DeFazio This article originally appeared in Bank Director. Ask 100 bankers to define what it means to be the primary financial institution for a consumer, and you’ll likely get 100 different answers. Ask 100 consultants to bankers what being the primary FI entails, and you’ll probably get 100 more…

Read MoreEvolution Can Be More Dangerous than Revolution: Digital Adoption for US Banks and Credit Unions

By Adam Thompson While there’s a lot of talk about industry or technology revolution, the fact is it’s generally evolution that transforms an industry and lays waste to stragglers and the stubborn. One industry where we can see what digital evolution has done is in consumer retail. At the turn of the century, major…

Read MoreRecording: The Best of Mobile CX & Fintech Apps

Here’s your opportunity to see how fintech apps are taking over the minds of today’s consumers and changing the definition of financial advice. StrategyCorps’ Dave DeFazio demonstrates trending apps like Robinhood, Cash App, SoFi, and Affirm to better understand the new features that are increasing competitive pressures on today’s banking products. He shares ongoing research…

Read MoreMake Your Financial Institution a Financial First Responder

By Gregg Early When we talk about first responders, we usually envision law enforcement, military, and fire and rescue workers running towards danger as everyone else is running from it. But banks and credit unions can be financial first responders to the dangers – and opportunities – that occur in the lives of customers…

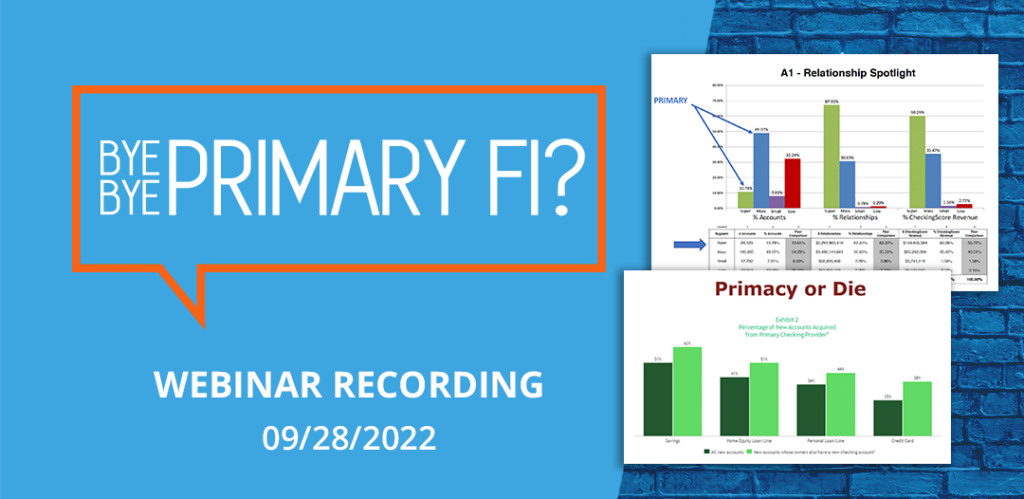

Read MorePresentation: Bye Bye Primary FI?

Download Slides Why primary relationships still matter and how to identify, optimize and lock them down. Is it still realistic to expect to be the primary financial institution for consumers who have so many choices where to bank? Does it still even matter if your financial institution is the primary one for consumers? The answer…

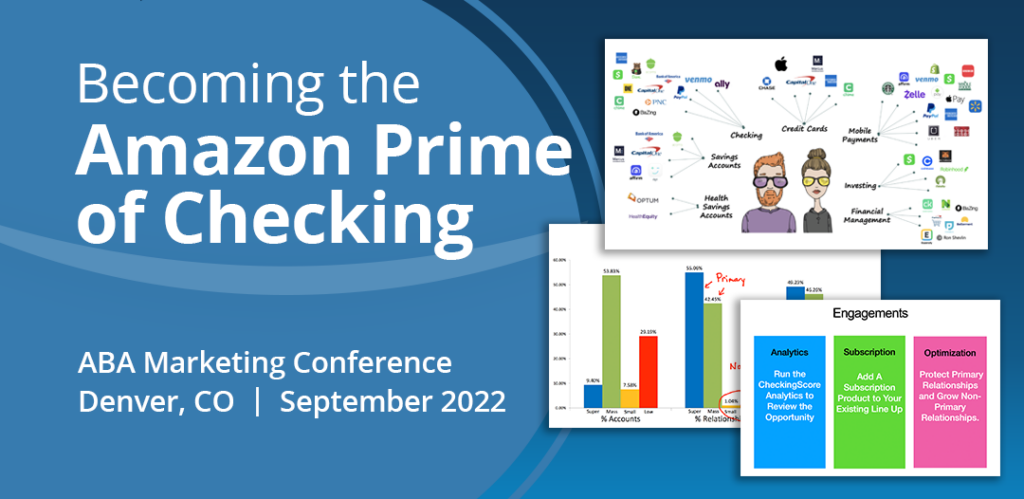

Read MorePresentation: Becoming the Amazon Prime of Checking

Download Presentation

Read MoreCornerstone Advisors and StrategyCorps Share a New Report on Addressing the Revenue Recession and Embedded Fintech Solutions for Banks and Credit Unions

BRENTWOOD, TN (August 3, 2022) — In a new research report, co-created by Cornerstone Advisors’ Ron Shevlin and StrategyCorps, Creating a Fintech Revenue Engine provides compelling insights and solutions to address the revenue recession driven by declining fee income and waning interchange income. The report is crucial for banks and credit unions hoping to remain…

Read MorePresentation: Close Encounters of the Fintech Kind

Download Presentation If it feels like fintech apps are taking over the minds of your consumers and changing the definition of financial service and advice—you might be right. How do they do it? Through live demonstrations of today’s trending apps, we’ll examine how the major fintechs are using subscriptions and incorporating data to pioneer recurring,…

Read MoreThe Scoop: Hot Takes on Today’s Retail Banking Issues

June 30, 2022 The issues bankers face regarding modern retail banking products and strategies aren’t for the faint-hearted. You have to make decisions with conviction and then be able to zig when you need to and zag when you have to. Otherwise, your FI will fall behind. And catching up isn’t easy. Here’s our scoop…

Read MoreOur Favorite Monthly Subscription? Our Community Bank!

Members of the Garrelts family, which includes Chris (the unseen photographer), his wife, Amy, and their three teens (Elizabeth, Max, and Claire), saved $35 per ticket at Universal Studios Hollywood — plus another $1,200 in unforeseen cell phone repair costs, all thanks to their checking account powered by BaZing. By Chris Garrelts As a father…

Read More