Use Good/Better/Best for Checking Success

Shop for a new car, a cell phone plan, a cable TV package, or a major appliance these days, and you’ll find one consistent and very successful product strategy: Good/Better/Best (GBB).

GBB is a three-tiered strategy conceptually defined as follows:

- Good: A basic level of value for price-sensitive customers. Good offers a minimal amount of value that slightly differentiates you from your competitors and/or marginally satisfies comparison shoppers. For example, Coach airline tickets fit into this category.

- Better: An in-between level of value for customers who appreciate the extras and are willing to pay a specific price to receive them because they’re still a bit price-sensitive. The amount of value-added above Good depends on the product type and marketplace. Still, the incremental level of value must be noticeable. For example, Business Class airline tickets would be perceived as being better than Coach, without what these customers might perceive as the exorbitant pricing that accompanies First Class tickets.

- Best: An advanced level of value for those customers who are actively looking for maximum added value. Price sensitivity is not a priority here, and the amount of value added above Better must be the maximum that is economically feasible to add while still maintaining acceptable profit margins and meeting strategic goals. The previously mentioned First Class airline tickets would be considered the Best option.

Every successful GBB design works best when product offerings build upon each other:

- Your Good product is fundamental.

- Better is Good plus more.

- Best is Better plus more.

The power behind GBB is simplicity and familiarity.

GBB provides choices by simple comparison, making it easy for customers to see how prices change as different features are added or subtracted. As a result, they will be content that they’ve made the right decision to buy exactly what they needed.

While buyers appreciate choice, too many choices are counterproductive.

In “The Paradox of Choice,” author and psychologist Barry Schwartz posits — and I’m paraphrasing here — that too many options actually discourage (rather than encourage) buyers to buy. An overabundance of choice increases the effort that goes into making a buying decision. So buyers decide not to decide, and they don’t buy your product.

Or if they do buy, the effort to make the decision often diminishes the feeling of enjoyment they would have derived from the product itself.

In short, buyers do not respond well to choice overload, and GBB keeps it simple. It’s very familiar to think in terms of three when buying things. The widespread use of GBB by retailers for commonly purchased items has conditioned the typical buyer to be at ease with this product design.

Simplicity works well for sellers.

With GBB, there are only three options to understand and communicate to a buyer. Sellers feel credible as GBB appeals to a broader market, providing something for everyone without requiring everyone to buy the premium option.

So how does this all relate to your consumer checking lineup strategy? It allows you to align your GBB checking products with the three types of checking account buyers:

- Fee-averse buyers want free checking (if it’s available) or the cheapest account you offer.

- Value buyers are most focused on account benefits. They are willing to reasonably pay for an account if they perceive a fair exchange of value.

- Interest buyers demand some yield on their deposits and expect to be rewarded for being productive or loyal customers.

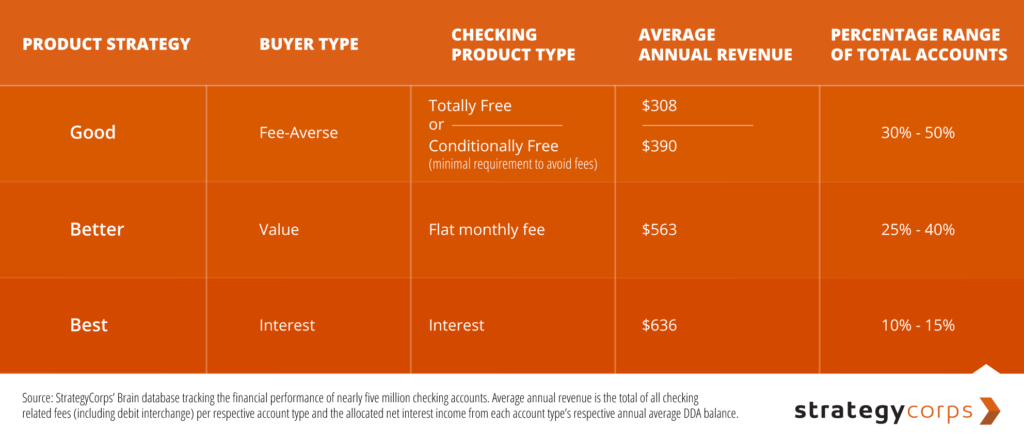

In a GBB-structured lineup, all three checking products (save for totally free checking) are optimized to generate or get close to generating enough annual revenue to cover the yearly costs to service a typical checking account relationship, which is $350.

Here’s how that breaks down — I’ve also added the comparative average annual revenue from each GBB checking product type and typical distribution of these accounts in a checking portfolio:

Imagining what a GBB-based checking lineup looks like for your financial institution?

StrategyCorps can help. As your financial institution works to have a more successful checking lineup that’s modern, customer-engaging, competitively different, and optimally, financially productive, we can show you how the successful product design strategy of GBB can work for your FI — happier customers and a healthier bottom line.

Mike Branton directs overall corporate financial strategy and operations performance at StrategyCorps and is responsible for the bottom-line performance of the business. You can reach him on LinkedIn or by email at mike.branton@strategycorps.com.