Posts Tagged ‘Checking Accounts’

StrategyCorps and Bank Strategic Solutions Announce Strategic Partnership

BRENTWOOD, TN (December 8, 2021) — StrategyCorps, an industry-leading provider of consumer checking-related analytical and mobile reward solutions that help banks and credit unions across the country optimize financial productivity and enhance customer engagement, has partnered with Bank Strategic Solutions, a leading provider of risk management services to financial institutions. “This partnership is a great…

Read MoreMonetize This!

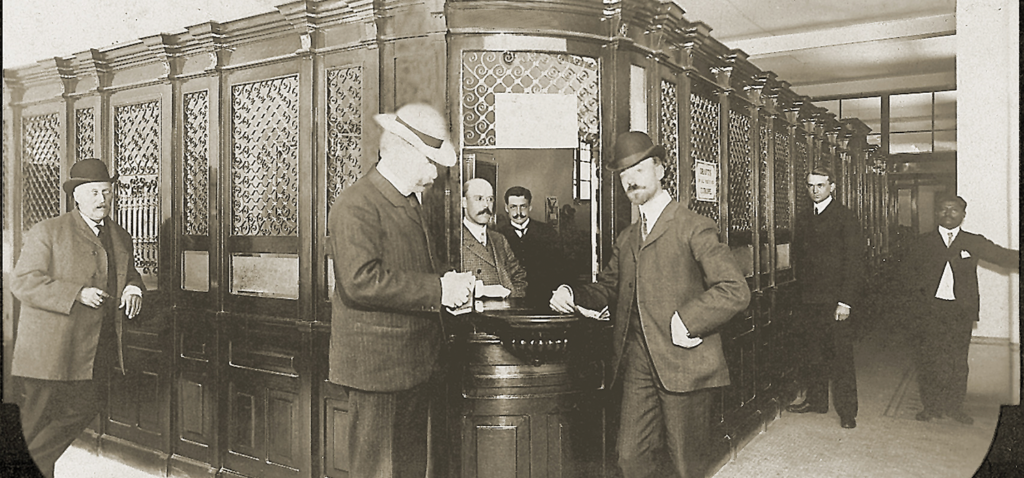

Since the founding of the first U.S. bank, customers have expected to do their banking in the most modern way possible. By Ryan Harbry Imagine the following conversation: Customer service representative: “So, is this the right account for you?” New customer: “Yes, sounds great.” Customer service representative: “Excellent. In which case, I suggest signing up…

Read MoreHow Capital One’s new policy will affect your bottom line

By Dave Pond In a stunning move, Capital One announced Wednesday plans to scrap overdraft and NSF fees for consumers beginning in Q1 2022. In an email to employees, Capital One CEO Richard Fairbank said the move was “our effort to bring ingenuity, simplicity and humanity” back to banking, according to USA Today reports. The…

Read MoreMake Gen Z Your Plan A

By Dave Pond During my college years, I couldn’t walk past the university bookstore without being surrounded by men and women offering free t-shirts — all I had to do was apply for a new credit card. That’s no longer legal, and it’s a good thing. See, thanks to those offers, I regularly flirted with…

Read MorePrimary Relationships or Bust

By Ryan Harbry Customer loyalty is essential in every industry under the sun. In banking, it matters even more than most industries because not only do unloyal customers represent a missed opportunity for revenue; they have the potential to cost more than they are bringing in — creating a drag on earnings. And, if we’re…

Read MoreDigital Banks Are Winning With Product Differentiation

Conventional wisdom—and even some of challenger banks’ own advertising—holds that fintechs are winning customers because they provide a superior customer experience and have better mobile banking tools. But it’s more than that. Digital banks are competing successfully with two additional strategies: 1) product featurization, and 2) segment specialization. Chime is a good example of a…

Read MoreSquirrels? Aww, nuts!

By Dave Pond A few weeks ago, my 16-year-old daughter, Mallory — with her sights firmly focused on a successful driver’s license road test at our local DMV — wanted to practice parallel parking in my trusty ol’ Ford Explorer. (After all, it was smaller than her mom’s minivan.) However, when they cranked it up, the…

Read MoreTales of Decommoditization

By Ryan Harbry Commoditization has been around for about as long as the banking industry itself — there’s no avoiding it. Whenever a good or service comes along and is successful (proving its proof of concept), other companies throw their hat in the ring, join the market, and compete. In legacy industries like banking, so…

Read MoreWhat’s More Important, Product or Product Distribution?

By Mike Branton Ask 100 retail bankers, and 99 will tell you they’re working on some sort of digital distribution channel for their consumer banking products: online account opening, digital loan application, digital cross-selling, mobile marketing, etc. Nearly every survey you see published shows financial institutions making digital product distribution at least a top-five priority…

Read MoreThe Name of the Game? Product Value

By Dave Pond During a recent episode of the Marketing Money podcast (helmed by John Oxford, director of marketing at Renasant Bank, and Mabus Agency owner Josh Mabus), I was excited to hear the topic of conversation turn from product naming toward product value. >> Marketing Money Ep. 125 (31:00) | LISTEN After all, nothing…

Read More