Posts Tagged ‘customer experience’

What’s More Important, Product or Product Distribution?

By Mike Branton Ask 100 retail bankers, and 99 will tell you they’re working on some sort of digital distribution channel for their consumer banking products: online account opening, digital loan application, digital cross-selling, mobile marketing, etc. Nearly every survey you see published shows financial institutions making digital product distribution at least a top-five priority…

Read MoreThe Name of the Game? Product Value

By Dave Pond During a recent episode of the Marketing Money podcast (helmed by John Oxford, director of marketing at Renasant Bank, and Mabus Agency owner Josh Mabus), I was excited to hear the topic of conversation turn from product naming toward product value. >> Marketing Money Ep. 125 (31:00) | LISTEN After all, nothing…

Read MoreA Discussion on the Evolution of Fintech

Bryan Clagett, Director of Strategic Initiatives at StrategyCorps, has been featured on The Financial Experience Podcast! Each episode explores innovations and innovators across the financial and fintech industries.Hear our very own, Bryan Clagett, and former banker and current agency owner, Hunter Young, discuss the evolution of fintech on Episode 07: Where Will Data, Digital And Fintech…

Read MoreStop Trying to Talk Your Customers Into Liking Your Checking Accounts

Recently I was reading an article from Chris Nichols, Chief Strategy Officer of Winter Haven, Florida-based CenterState Bank, entitled Public Perception of the Cost of Checking. Nichols shares how CenterState interviewed 200 randomly selected potential customers about what they thought about the bank’s pricing and value of its checking accounts. The pricing ranges from a fee of $5.95…

Read MoreReinventing Checking Accounts as Digital Rewards Platforms

In a recent study by Ron Shevlin of Cornerstone Advisors, commissioned by StrategyCorps, consumers are asked about their interest in a hypothetical Amazon-offered checking account bundle, and the results reveal a meaningful lesson to banks and credit unions – consumers are willing to pay for value in banking products.

Read MoreNew Research Commissioned by StrategyCorps Reveals Consumer Attitudes Towards “Amazon Prime” of Checking Accounts

In a recent study by Ron Shevlin of Cornerstone Advisors, commissioned by StrategyCorps, consumers are asked about their interest in a hypothetical Amazon-offered checking account bundle, and the results reveal a meaningful lesson to banks and credit unions – consumers are willing to pay for value in banking products.

Read MoreEdging Out the Competition

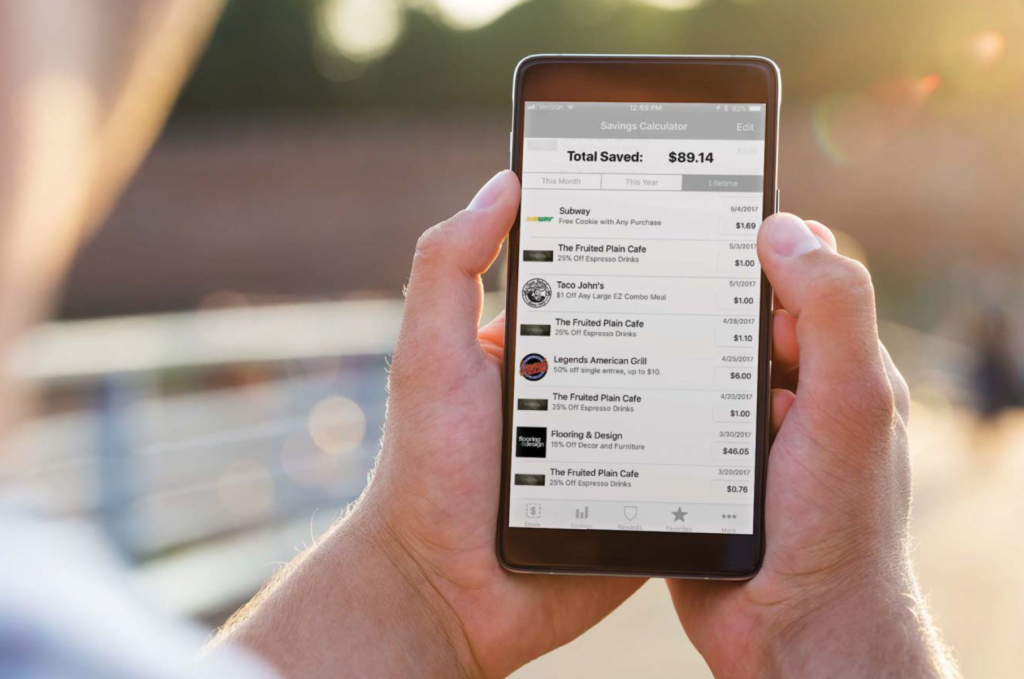

Learn how American State Bank of Iowa’s mobile coupon app is a win for customers, local businesses and the bank itself. See the latest Main Street Focus article of IB Magazine.

Read MoreStrategyCorps Receives BankNews Innovative Solutions Award Recognizing BaZing Mobile App

We’re excited to announce our win in the BankNews Innovative Solution Awards! Our BaZing mobile app was voted #1 Digital Banking Solution, an award to recognize companies that have significantly enhanced products designed to help financial institutions become more efficient, expand their capabilities and better serve their customers.

Read MoreStrategyCorps Awarded “Best in Bank Customer Experience” at BCX Summit

Big thanks to BCX Summit for our Best Mobile Experience by a Fintech Provider Award for our BaZing mobile app. We’re so honored to be the only domestic fintech company to receive this award!

Read MoreHow Modern Consumers are Redefining Their Relationships with Banks

Consumers’ relationships with banks are becoming dependent on how products and mobile banking fit in with their lifestyles. And if that relationship is going downhill, customers are much quicker to break up with their bank. That’s why leading banks are on the prowl to find the next great way to offer more than just the basics. They’re adding interesting features to mobile, introducing ways to help customers save money and offering more relevant benefits — all to create positive, lasting relationships with customers.

Read More