News

Happier Half Hour

StrategyCorps Presents Happier Half Hour: A LIVE Broadcast Everyone can use a little extra “happy” in their lives, so join the StrategyCorps team as we present Happier Half Hour LIVE! In our live segments, we invite friends and local businesses to share their talents, hobbies, passions, and stories. In return, we will dedicate each session…

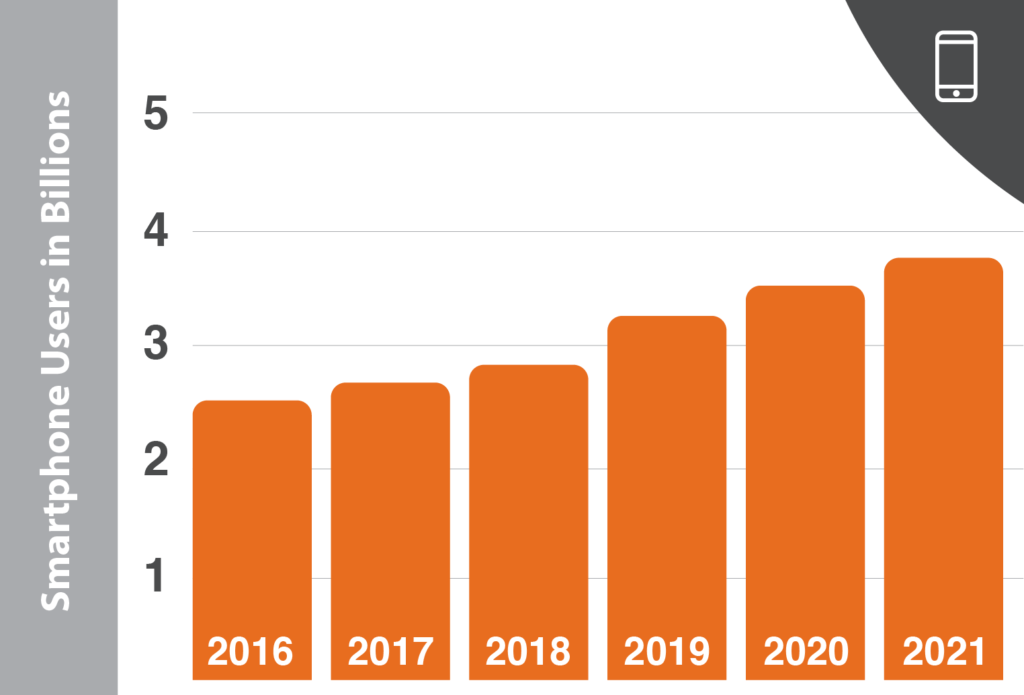

Read MoreSmartphone Ownership Surpasses Three Billion

The number of smartphone users worldwide surpassed three billion in February and is forecast to further grow by several hundred million in the next few years. While there has been some stagnation in smartphone purchases, the smartphone market still has high growth potential as the smartphone penetration rate is still lower than 70% in most…

Read MoreIn Time of Crisis, Leaders Must Communicate Carefully and Thoughtfully

Most of us likely never anticipated being in the throes of a pandemic, but here we are. The potential loss of life and economic impact is unknown, and that has led to fear. This is completely understandable. These are challenging times complicated by the dynamics of social media and political in-fighting. Your financial institution is…

Read MoreStrategyCorps Voted One of the 2020 Best Places to Work in Financial Technology

We are thrilled to share that we’ve been named one of the 2020 Best Places to Work in Financial Technology! It’s great to know that our employees love coming to work every day and are motivated to put forth their best effort and support each other by the company culture that we’ve cultivated over the…

Read MoreBaZing Gets a New Look With an Updated UI

We have good news. BaZing just got even better! We’re bringing the BaZing app into 2020 with a refreshed and updated user interface. This update will give BaZing users a modern design, intuitive navigation, and overall better user experience. What’s new: The Home Page The BaZing home page now consists of a set of interactive…

Read MoreAmazon’s Case for Offering Free Checking Accounts

The speculation around Amazon’s potential entrance into banking has only heightened, thanks to the recent reports of Amazon being in talks with big banks like JPMorgan Chase and Capital One. While it’s unlikely that Amazon actually plans to become a bank itself, these types of partnerships further reveal that getting in on the banking action is moving up on its “take over the world” to-do list.

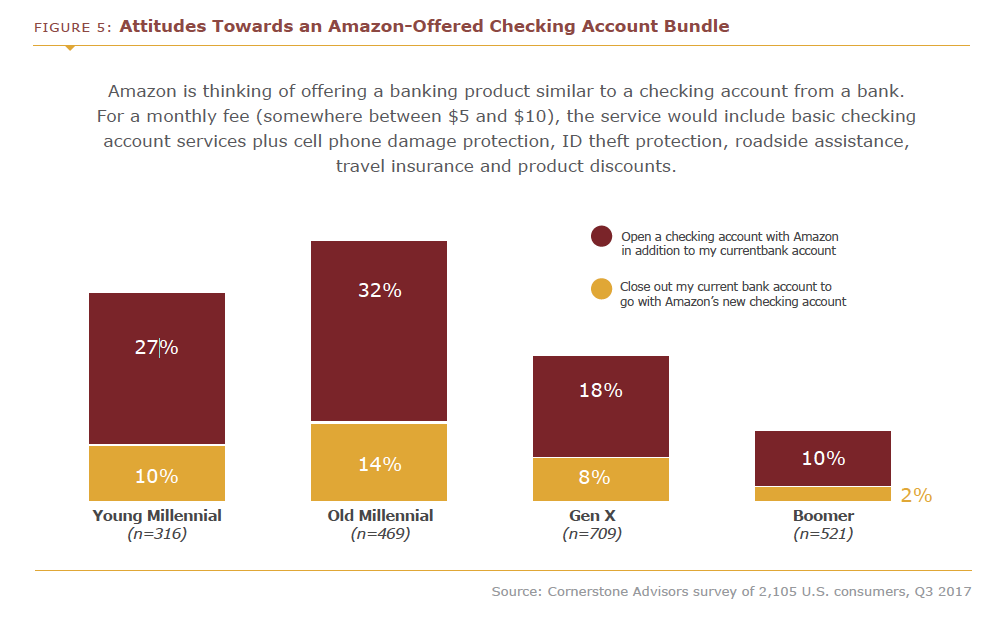

Read MoreWhat if Amazon Offered a Checking Account?

Amazon Prime, Video, Music, Fresh, Alexa—all loved by many, but would consumers also care for an Amazon checking account? One recent survey says that, yes, a subscription based, value-added checking account is the best thing since free two-day shipping.

Read MoreReinventing Checking Accounts as Digital Rewards Platforms

In a recent study by Ron Shevlin of Cornerstone Advisors, commissioned by StrategyCorps, consumers are asked about their interest in a hypothetical Amazon-offered checking account bundle, and the results reveal a meaningful lesson to banks and credit unions – consumers are willing to pay for value in banking products.

Read MoreNew Research Commissioned by StrategyCorps Reveals Consumer Attitudes Towards “Amazon Prime” of Checking Accounts

In a recent study by Ron Shevlin of Cornerstone Advisors, commissioned by StrategyCorps, consumers are asked about their interest in a hypothetical Amazon-offered checking account bundle, and the results reveal a meaningful lesson to banks and credit unions – consumers are willing to pay for value in banking products.

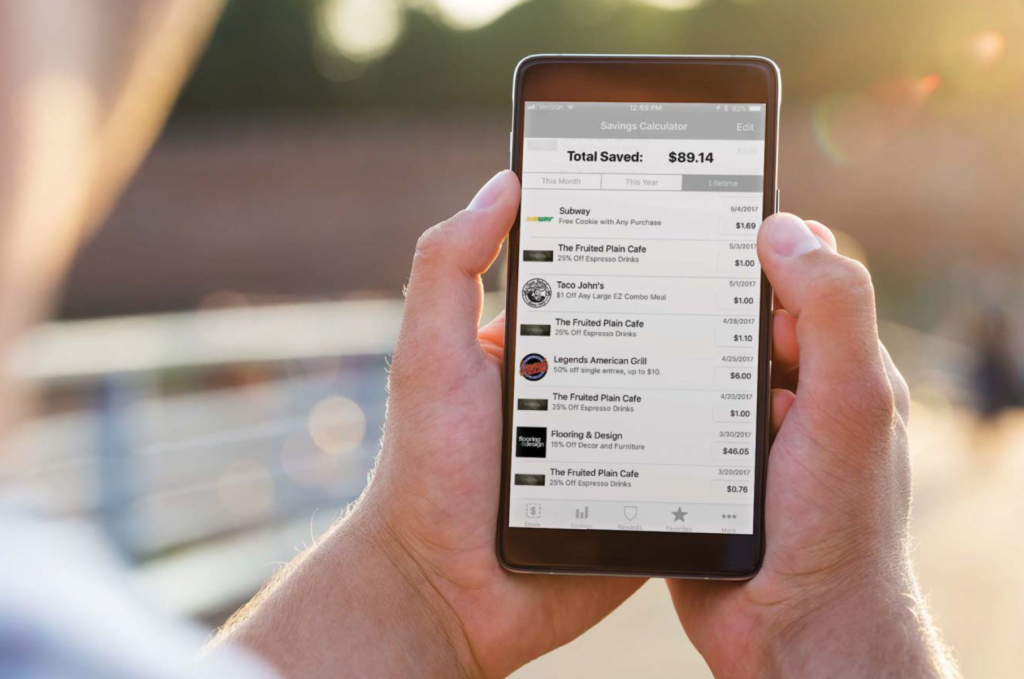

Read MoreEdging Out the Competition

Learn how American State Bank of Iowa’s mobile coupon app is a win for customers, local businesses and the bank itself. See the latest Main Street Focus article of IB Magazine.

Read More