What Bankers Should Know About Consumer Checking Financial Performance

By Mike Branton, Tyler Spaid

Originally posted on BankDirector.com Jan. 25, 2016

Every financial institution (FI) is trying to optimize the financial potential of a checking account customer. Mega banks are paying up to acquire a checking customer from another institution. And all FIs are pursuing the elusive cross-sell to round out a checking account customer that is inherently unprofitable on a single product basis.

StrategyCorps actively tracks, quantifies, ranks and analyzes nearly 4 million checking account relationships of primarily community FIs (below $10 billion in assets) related to our CheckingScore analytical solution in a database that we affectionately call “The Brain.” Each checking relationship is scored by the total annual revenue it generates on a household basis (the total of demand deposit account fees plus estimated net interest income on DDA balances and related deposits and loans) and then ranked into four relationship segments:

- Super: annual revenue over $5,000

- Mass Market: annual revenue of $350 to $5,000

- Small: annual revenue of $250 to $350

- Low: annual revenue less than $250

Based on our experience as well as the research of industry groups like the American Bankers Association, the Federal Deposit Insurance Corp. and banking consultants, we have determined that those relationships scoring below $350 don’t generate enough revenue to cover the FI’s cost to service the relationship.

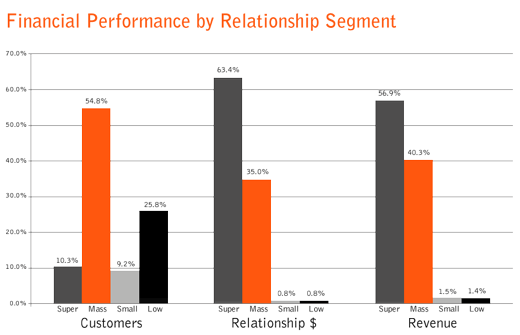

The distribution of these relationship segments by customer count, dollars of relationships and revenue is a much skewed one:

- 35 percent of Low and Small relationship customers represent only 1.6 percent of all relationship dollars and 2.9 percent of revenue

- 10 percent of the Super relationship customers represent 63 percent of relationship dollars and 57 percent of revenue.

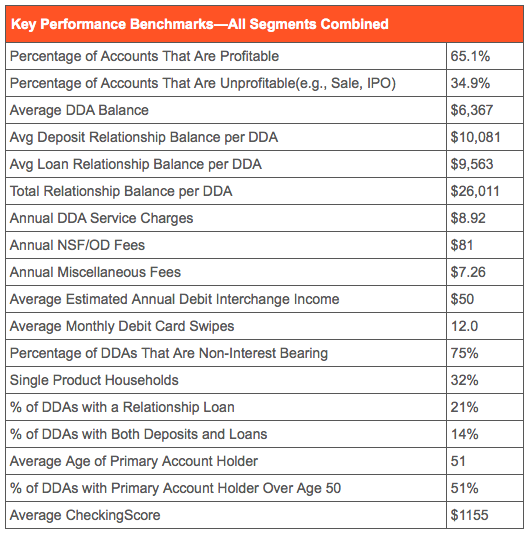

Below are some more key performance benchmarks that show the average financial performance of all four relationship segments combined for a typical financial institution, according to The Brain database.