Posts Tagged ‘fintech’

StrategyCorps and Bank Strategic Solutions Announce Strategic Partnership

BRENTWOOD, TN (December 8, 2021) — StrategyCorps, an industry-leading provider of consumer checking-related analytical and mobile reward solutions that help banks and credit unions across the country optimize financial productivity and enhance customer engagement, has partnered with Bank Strategic Solutions, a leading provider of risk management services to financial institutions. “This partnership is a great…

Read MoreMonetize This!

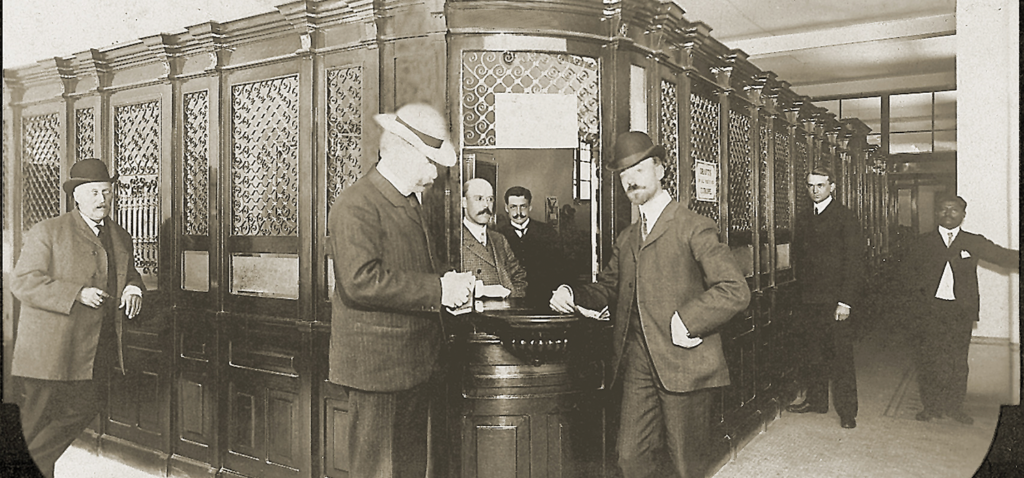

Since the founding of the first U.S. bank, customers have expected to do their banking in the most modern way possible. By Ryan Harbry Imagine the following conversation: Customer service representative: “So, is this the right account for you?” New customer: “Yes, sounds great.” Customer service representative: “Excellent. In which case, I suggest signing up…

Read MorePrimary Relationships or Bust

By Ryan Harbry Customer loyalty is essential in every industry under the sun. In banking, it matters even more than most industries because not only do unloyal customers represent a missed opportunity for revenue; they have the potential to cost more than they are bringing in — creating a drag on earnings. And, if we’re…

Read MoreCompeting with the Gigantosauruses and Digitalbatrosses

I know you’re thinking that this isn’t a great analogy because dinosaurs are extinct, and an “albatross” is a psychological burden that feels like a curse. But gigantosauruses are (OK, were) huge, powerful animals (like the Big Tech companies) and albatrosses are one of the fastest species of animals, flying at nearly 80 miles per…

Read MoreDigital Banks Are Winning With Product Differentiation

Conventional wisdom—and even some of challenger banks’ own advertising—holds that fintechs are winning customers because they provide a superior customer experience and have better mobile banking tools. But it’s more than that. Digital banks are competing successfully with two additional strategies: 1) product featurization, and 2) segment specialization. Chime is a good example of a…

Read MoreTales of Decommoditization

By Ryan Harbry Commoditization has been around for about as long as the banking industry itself — there’s no avoiding it. Whenever a good or service comes along and is successful (proving its proof of concept), other companies throw their hat in the ring, join the market, and compete. In legacy industries like banking, so…

Read MoreThe Big Tech Threat (Opportunity?)

In November 2019, Google announced that it was going to launch a checking account. The announcement elicited the typical frenzy in the press about how the Big Tech company and its fellow Gigantosauruses were going to put traditional banks out of business. But — surprise, surprise—that wasn’t the game plan. The plan was to partner…

Read MoreInside the Digital Bank Insurgency of 2020

The pandemic should get a lot of the credit for this, but 2020 was a good — no, make that a great — year for challenger banks and the broader group of digital banks. At the beginning of 2020, just 3 percent of U.S. consumers considered a digital bank to be their primary bank. By…

Read MoreIs Your Financial Institution Feeling the Burn?

When the first so-called “challenger banks” like Simple and Moven appeared on the scene around 2010 they were heralded as “disruptors” that were going to put traditional banks and credit unions out of business. Why? The asserted logic was that they provided a better customer experience, were more customer-friendly in terms of pricing (i.e., no…

Read MoreReinventing the Checking Account

Is it “game over” for mid-size banks and credit unions when it comes to checking accounts? Are the threats from deposit displacement, P2P providers, Amazon, and megabanks insurmountable? No. Despite the prevalence of free checking accounts, many consumers express interest in switching to that hypothetical Amazon-offered bundled checking account we discussed earlier in this report.…

Read More