Serve Where Customers Expect You to Be

When my 15-year-old daughter needs money to chip in for a car-owning friend’s next fuel fill-up or dinner out with her boyfriend, she doesn’t ask if I can swing by the ATM for her.

She doesn’t ask to go to the bank with me, nor does she take checks. Heck, I don’t even think she’d know what to do with a check if I handed her one.

In most cases, I get a single notification on my phone, letting me know she’s requesting money through Venmo, a tool that allows me to make sure she’s gassed up and fed without missing a single minute of whatever show I’m binge-watching at the moment.

Convenience is king—even more so during this COVID era—and my, your, and your customers’ financial behaviors are changing to reflect those preferences. See, banks aren’t the answer for them— an app is.

If you haven’t noticed already, a legion of challengers has risen to the challenge, stepping up and stepping in to fill the void by turning my teen’s smartphone menu into a buffet lined with financial tools and services that are just a single tap away.

Convenience is king—even more so during this COVID era—and my, your, and your customers’ financial behaviors are changing to reflect those preferences. See, banks aren’t the answer for them— an app is.

But it’s not just one app. Right now, your customers are using single-service apps, multi-solution apps that allow them to manage a host of financial issues in one place, or a series of partner apps that prey on our longing to be connected to one another (so why shouldn’t our apps, right?)

Banking for Humans

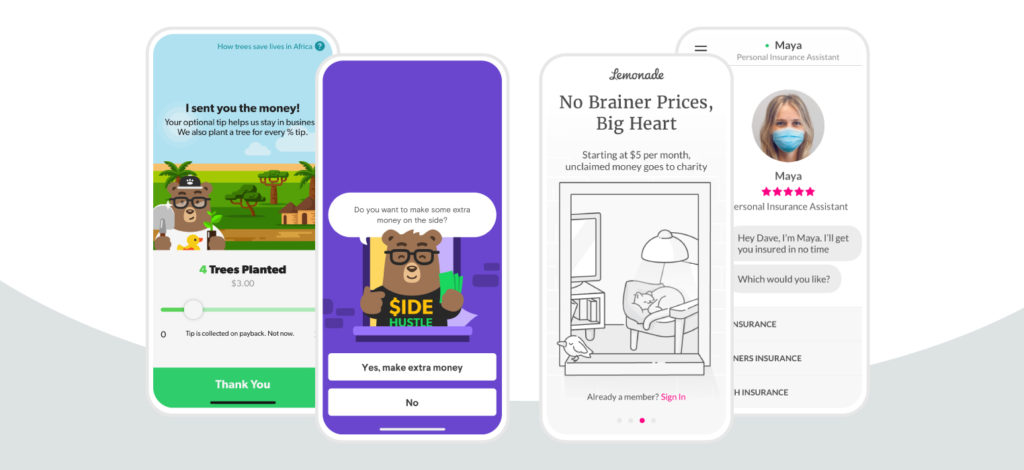

Take Dave, a Mark Cuban-backed mobile app that boasts an empathetic tone and a real-world, customer-focused voice that’s low on “bank speak,” which allows Dave to put its members’ financial minds at ease.

For just $1 a month, this fee-based solution will analyze your upcoming bills, income, and spending habits to let you know how much wiggle room you actually have in your synced checking account. Dave tells it like it is, in ways that help paycheck-to-paycheck consumers take the thought out of day-to-day budgeting and money management. Pretty handy, huh?

But what Dave really does is help your customers avoid paying overdraft fees. That’s the crowd Dave is marketed to — and today, there are over seven million Dave members.

By allowing its members to get paid up to two days early and get up to $100 cash advances, Dave’s found a way to plunder your FI’s fee income, add some of its own, and empower your customers while doing so. Dave doesn’t even charge a fee for cash advances—instead, it offers its members the opportunity to “tip” for the service they’ve received.

Forget Everything You Know

Now let’s look beyond the branch and into what many of us call our “family of services.” Have you heard of Lemonade yet? If not, you’ll want to check it out. This fintech—or “insurtech” if you want to get more specific—unicorn has completely turned the traditionally stale, formal, stuffy insurance business upside down.

Lemonade begins the customer journey by imploring its users to “forget everything you know about insurance.” Terms like “transform insurance from a necessary evil into a social good,” “instant everything,” and “built for the 21st century,” drive Lemonade’s content marketing efforts more than anything insurance-related.

In an industry in which, to most, insurance is insurance is insurance, Lemonade focuses less on itself and more on the consumer. (First Dave, now Lemonade — see a trend developing here?)

“Lemonade reverses the traditional insurance model,” its website declares. “We treat the premiums you pay as if it’s your money, not ours. With Lemonade, everything becomes simple and transparent. We take a flat fee, pay claims super fast, and give back what’s left to causes you care about.*

Here’s another delighter: Lemonade’s customers pick what nonprofits they want to support. In 2020 alone, Lemonade has given back more than $1.1M (up from $631K just a year ago).

In an industry in which, to most, insurance is insurance is insurance, Lemonade focuses less on itself and more on the consumer.

But that’s not to say Lemonade isn’t incredibly profitable. Shares of Lemonade (LMND), which hit a record $144 during their first day on market (following a $29 IPO price), have consistently traded at more than double their initial offering.

Lemonade’s methods are rather simple. Since its founders decided to become a licensed insurance carrier—meaning it decided not to sell other people’s policies—Lemonade can offer renters insurance starting at just $5/mo., pet insurance from $10/mo., and homeowners insurance from $25/mo.

“The company takes 25% of insurance premium revenue for administrative costs and potential profits,” according to a 2019 Forbes article that explores how the sausage (or Lemonade) is made. “The other 75% is used to fund customer claims, buy reinsurance (laying off some risk) and pay certain taxes and fees, with anything left going to charities that customers choose.”

Pretty awesome, right? Lemonade has determined what will satisfy its clients: Transparent pricing, fast claims service, and being associated with a company that does good for and in the world around it. My guess is that yours feel the same way.

It’s Not Too Late

Here’s the deal. Fewer and fewer customers are coming to traditional banks to meet their financial needs (which stretch far beyond my daughter’s after-school snacks and Friday night fill-ups.) It doesn’t have to be this way. You have the opportunity to be the answer to what your customers are looking for, asking for, and using on a daily basis.

Society is changing, and you must grow with it. Accessorizing your checking accounts (and other products) with value-added services consumers want and those they’re already paying for elsewhere makes perfect sense.

Best of all, you can start right now. Make a plan to serve your customers beyond the basics with all you are as a brand, meeting their financial needs in ways they expect you to—not how the industry has done it for years.

By Dave Pond

Value-added services have a place in the lifestyles of consumers, and according to our research, it’s clear they want them. It’s time for banks and credit unions to accessorize their checking account offerings with these valuable additions. To delve deeper into this research and learn how to best optimize the value of checking accounts, download our free white paper today.