Make Gen Z Your Plan A

By Dave Pond

During my college years, I couldn’t walk past the university bookstore without being surrounded by men and women offering free t-shirts — all I had to do was apply for a new credit card.

That’s no longer legal, and it’s a good thing. See, thanks to those offers, I regularly flirted with several $500 credit limits, no thanks to late-night pizza deals, football-themed t-shirts that actually did cost money, and a cavalier, “I’ll-pay-for-it-later” attitude toward my finances.

Things are different on today’s university campuses, but today’s tech-savvy students are still on the hunt for a good deal — as well as tech-friendly banks to help them manage their finances. That only goes so far.

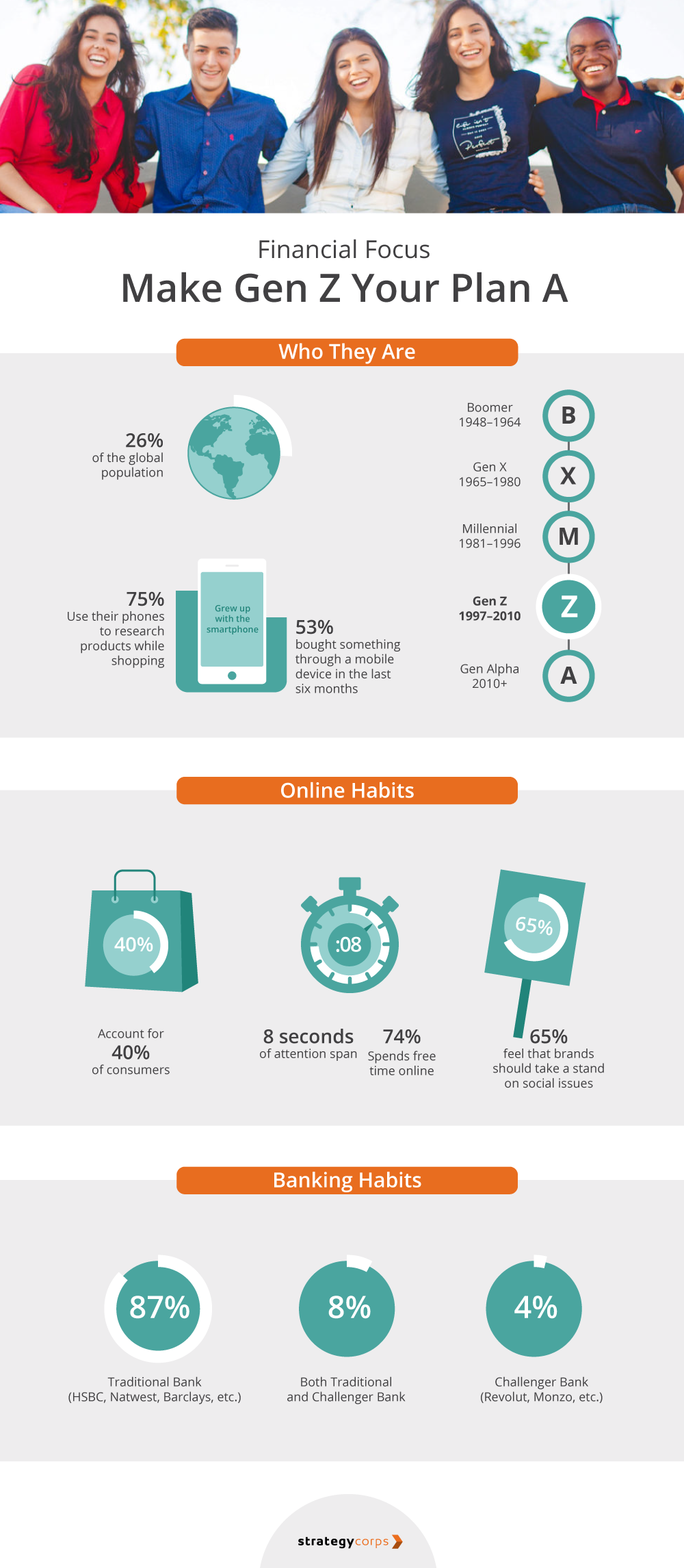

“Almost nine out of ten Gen Z consumers (87%) still prefer traditional banking providers to the competitive neobanks and fintechs who are dominating the news,” according to a new Marqeta study highlighted by The Financial Brand.

I’ll freely admit that older Gen Z students are savvier than I was — where I saw free money, they ask, “what’s the catch?” Despite that, brand recognition and a reputation of stability remain paramount, which gives established banks and credit unions a distinct advantage over what 18-22 year-olds consider to be a rash of indistinguishable fly-by-night fintechs buying loads of ad space on their favorite social media platforms.

So, what’s today’s free toaster or free t-shirt? I’d argue that value-added services (those that make your checking accounts more than deposit-and-withdrawal destinations) can help you reach Zoomers in ways you haven’t been able to before.

According to the Institute of Education Sciences, the median distance college students live from home is 94 miles. With nearly 200-mile round trips on the docket several times a semester, a checking account that includes 24/7 roadside assistance could really rise to the top.

Every college student wants to save money, well, because they don’t ever seem to have enough. In a world in which an astonishing 85% of college students use debit cards regularly, why not let them turn those interchange fee-boosting swipes into BaZing Fuel discounts that can be redeemed right at the pump?

More ways to save? From the aforementioned late-night pizza to discounts on clothes, tech, and more, you can help provide university-area small businesses a boost simply by providing students access to local deals and discounts that update whenever they’re on campus, on the road, or back at home.

We could go on and on, but I’ll close with this. Now’s your opportunity to set your financial institution’s checking account lineup apart from others — especially those offered by fintechs, neobanks, and digital banks. Gen Zers are telling us they’d rather bank with a traditional bank or credit union, so listen to them!

And, of course, we can help. Let StrategyCorps help you shift your focus from declining fee revenue and help you provide university-aged customers or members with nearly a dozen distinct checking account features and benefits that they’re paying third-party companies more money out-of-pocket for today.

Meanwhile, you’ll generate valuable repeat revenue, boost your FI’s appeal to a new audience, and deepen customer or member relationships.

Dave Pond is a marketing content strategist at StrategyCorps. Value-added services like roadside assistance, fuel discounts, and shopping deals have a place in the lifestyles of Gen Z consumers, and according to our research, it’s clear they want them. It’s time for your bank or credit union to accessorize their checking account offerings with these valuable additions. To learn how to best optimize the value of your retail checking accounts, contact us today.