Market Expertise, Research and News

Bookmark this page for the latest content, expert interviews and StrategyCorps news.

StrategyCorps Presents Happier Half Hour: A LIVE Broadcast Everyone can use a little extra “happy” in their lives, so join…

Read More“In This Together” campaign lets banks and credit unions provide savings on prescriptions and eye and hearing care. BRENTWOOD, Tennessee,…

Read MoreThis content originally appeared here: [ LINK ] By Mike Branton Clearly, things in the marketplace are very uncertain at…

Read MoreHow has COVID-19 become a wake-up call for financial services? The COVID-19 crisis has been almost an instantaneous reveal of…

Read MoreThe COVID-19 crisis will likely ever alter the payment landscape. While it is premature to report usage stats, here’s a…

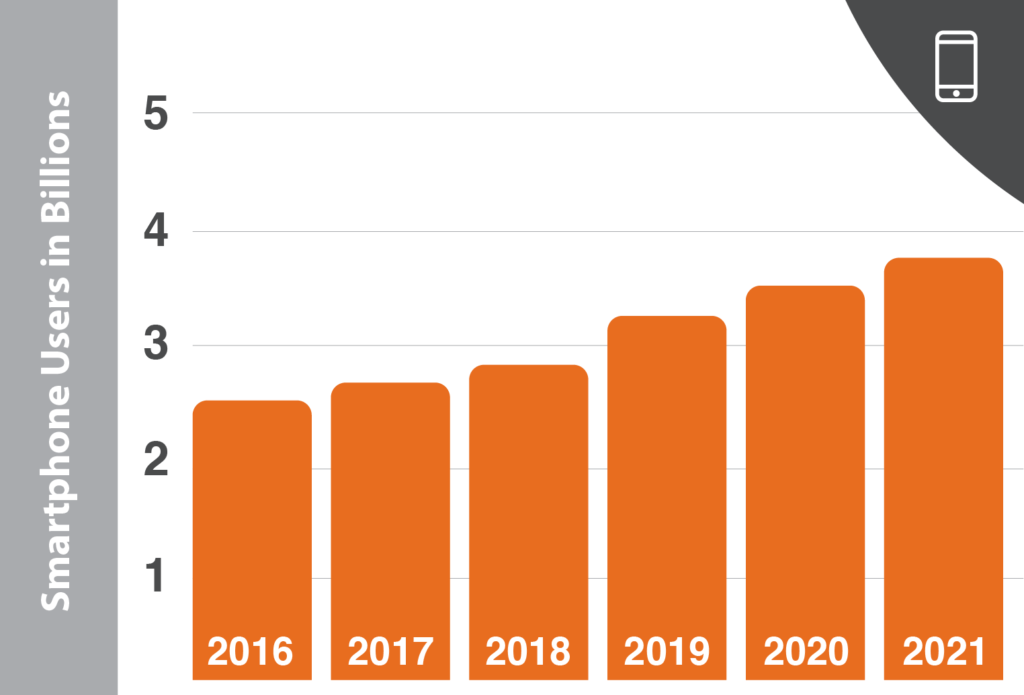

Read MoreThe number of smartphone users worldwide surpassed three billion in February and is forecast to further grow by several hundred…

Read MoreClearly, no brand should exploit the Coronavirus pandemic, but what can banks and credit unions now do to demonstrate authenticity? …

Read MoreMost of us likely never anticipated being in the throes of a pandemic, but here we are. The potential loss…

Read MoreNASHVILLE, TN, February 18, 2020 – StrategyCorps, a company that provides nearly 350 banks and credit unions with profitability analysis,…

Read MoreRecently I was reading an article from Chris Nichols, Chief Strategy Officer of Winter Haven, Florida-based CenterState Bank, entitled Public Perception of…

Read More