Market Expertise, Research and News

Bookmark this page for the latest content, expert interviews and StrategyCorps news.

Attract and retain consumers with engaging benefits and a plan to educate people about it By Trae Turner …

Read MoreIn the ever-transforming battle for customers/members, fintechs seek to be the new rulers of the banking universe. And the tides…

Read MoreBy Mike Branton and Dave DeFazio This article originally appeared in Bank Director. Ask 100 bankers to define what…

Read MoreBy Adam Thompson While there’s a lot of talk about industry or technology revolution, the fact is it’s generally…

Read MoreHere’s your opportunity to see how fintech apps are taking over the minds of today’s consumers and changing the definition…

Read MoreBy Gregg Early When we talk about first responders, we usually envision law enforcement, military, and fire and rescue…

Read MoreMassachusetts Bankers Association (MBA) is excited to announce its new relationship with StrategyCorps as a Preferred Provider. Since its founding…

Read MoreBy Gregg Early There’s no doubt that there’s a significant gap between the banking industry’s long-term strategic challenges before…

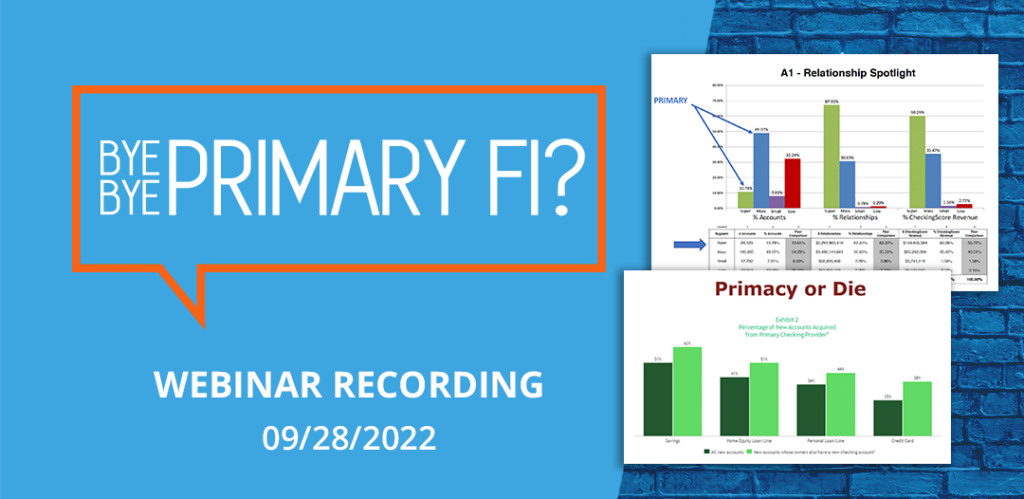

Read MoreDownload Slides Why primary relationships still matter and how to identify, optimize and lock them down. Is it still realistic…

Read More